Despite the rebound, Bitcoin remained down more than 5% over the past 24 hours.

- Solana led losses among major cryptocurrencies, falling 10% in the last 24 hours.

- Ethereum and Binance Coin each declined about 6.9%, with ETH’s price remaining below $2,000.

- Liquidations reached $2.5 billion over the past day, with Bitcoin accounting for more than half.

Bitcoin’s (BTC) climbed back to over $66,000 on Friday morning after barely holding above $60,000 during the previous session, while Solana (SOL), Ethereum (ETH) and Binance Coin (BNB) led the slide among crypto majors.

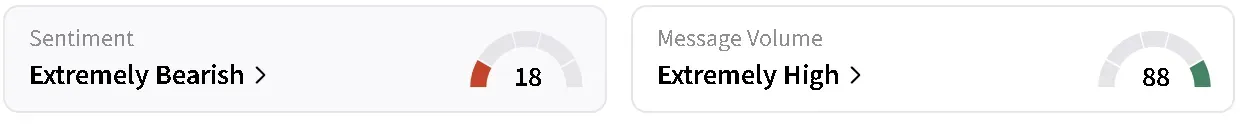

Bitcoin’s price was still down by 5.3% in the last 24 hours, trading at around $66,439. On Stocktwits, retail sentiment around the apex cryptocurrency remained in ‘extremely bearish’ territory over the past day, amid ‘extremely high’ levels of chatter.

Solana Slides But Sentiment Improves

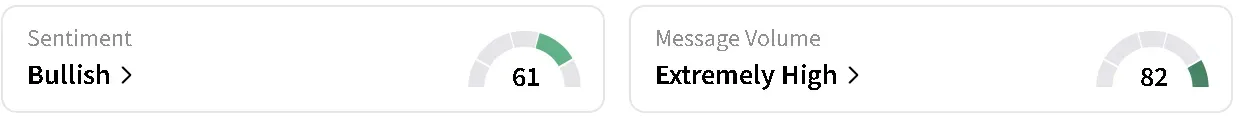

Solana’s price slid 10% in the last 24 hours, trading at around $81.50. This is after recovering from a low of $70.61 on Thursday. According to crypto analyst Ted Pillows, this could mark a local bottom for Solana with downside liquidity drying up. On Stocktwits, retail sentiment around the cryptocurrency improved to ‘bullish’ from ‘neutral’ territory over the past day with chatter at ‘extremely high’ levels.

Ethereum, BNB Extend Losses

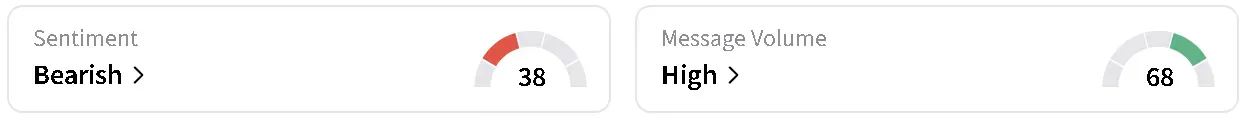

ETH and BNB fell around 6.9% each in the last 24 hours. Ethereum’s price remained under the $2,000 threshold, trading at around $1,928, and BNB’s price recovered to around $635 after falling below $600. However, while retail sentiment around Ethereum improved to ‘neutral’ from ‘bearish’ territory over the past day, retail sentiment around BNB moved in the opposite direction.

Liquidations Surge As Risk Appetite Fades

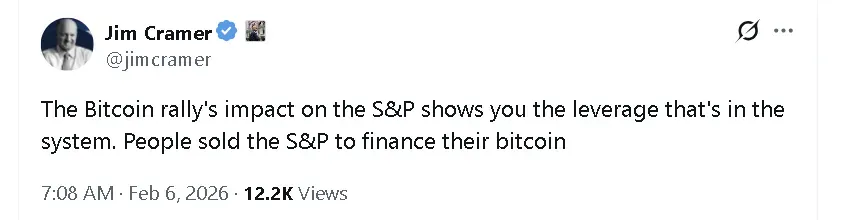

CNBC Mad Money host Jimmy Cramer said Bitcoin and the S&P 500 appeared to be moving in tandem during the selloff, suggesting that some traders may have sold equities to cover losses or raise cash for crypto positions.

The overall cryptocurrency market slid 3.9% in the last 24 hours to $2.35 trillion. Coinglass data showed liquidations at $2.5 billion over the past day, with forced unwinds around Bitcoin accounting for more than half of that value at $1.32 billion.

Read also: Bitcoin’s Slide Triggers MSTR’s Biggest One-Day Drop In Over A Year – But These Three Crypto Stocks Took a Bigger Hit

For updates and corrections, email newsroom[at]stocktwits[dot]com.<