At the end of the second quarter, Strategy held 628,791 bitcoins at a total cost of $46.07 billion or $73,277 per bitcoin.

Bitcoin prices slipped for two straight sessions after it ended Friday’s session just under $117,000, and the pullback prompted the digital currency’s evangelist and Strategy, Inc. CEO Michael Saylor to hawk the apex crypto.

Economist Peter Schiff, however, wasn’t one to take the bait.

In response to Saylor’s post on X that “Bitcoin is on sale,” Schiff said, “Says the man who leveraged up to go all-in on Bitcoin.”

Strategy, formerly known as MicroStrategy, was founded in 1989 as a data mining software company and evolved into an enterprise analytics company. The Tysons Corner, Virginia-based company has since diversified into a bitcoin investment company, loading up its balance sheet with the most popular cryptocurrency.

At the end of the second quarter, the company held 628,791 bitcoins at a total cost of $46.07 billion or $73,277 per bitcoin.

Saylor, one of Strategy’s co-founders, has utilized a combination of stock offerings, including both common stock and preferred stock, as well as debt, to fund the company’s bitcoin purchase.

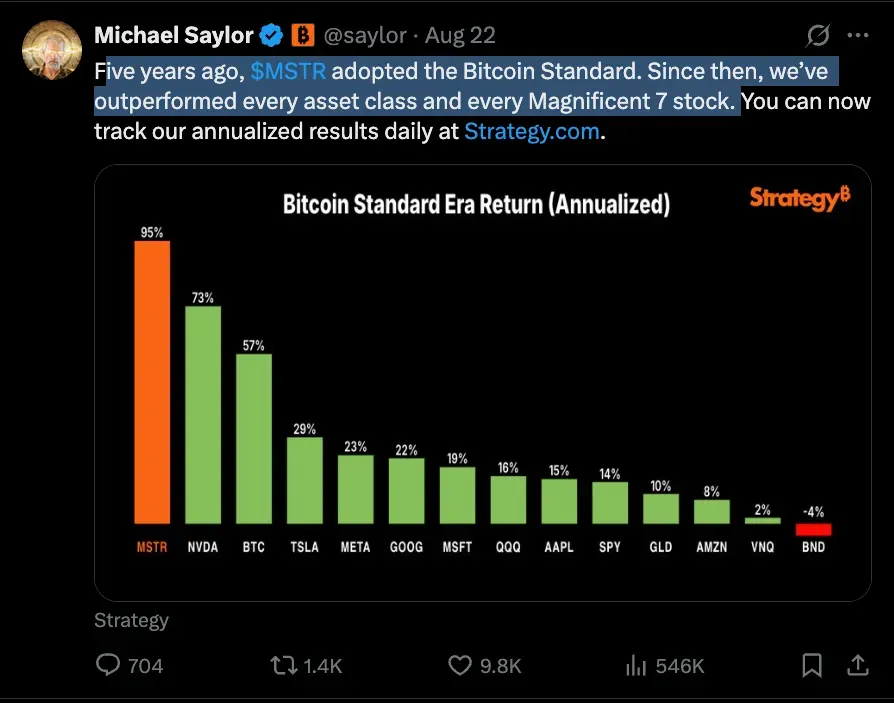

In an X post on Friday, the Strategy CEO said, “Five years ago, $MSTR adopted the Bitcoin Standard. Since then, we’ve outperformed every asset class and every Magnificent 7 stock.”

Since the start of the year, Bitcoin has gained approximately 21%, outperforming the 10.8% gain of the SPDR S&P 500 ETF Trust (SPY), an exchange-traded fund (ETF) that tracks the broader S&P 500 index.

Schiff went on to say that “If you really want to buy Bitcoin, wait until the Strategy going out of business sale.”

The economist is a strong proponent of gold but a strong opponent of Bitcoin. On Sunday, he shared a list of illustrious people who have called out the death of cryptocurrency, with him featuring at the top of the list. “At least I made the top of the Bitcoin obituary list,” he said.

On Stocktwits, retail sentiment toward Bitcoin improved to ‘neutral’ (48/100) by late Sunday from ‘bearish’ a day ago, following the recent pullback. The message volume on the stream was at ‘normal’ levels.

Sentiment toward Strategy stock remained 'bullish' but the message volume tapered off to 'normal' levels.

At last check, Bitcoin traded down 1.44% at $113,353.35. Strategy stock is up about 24% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<