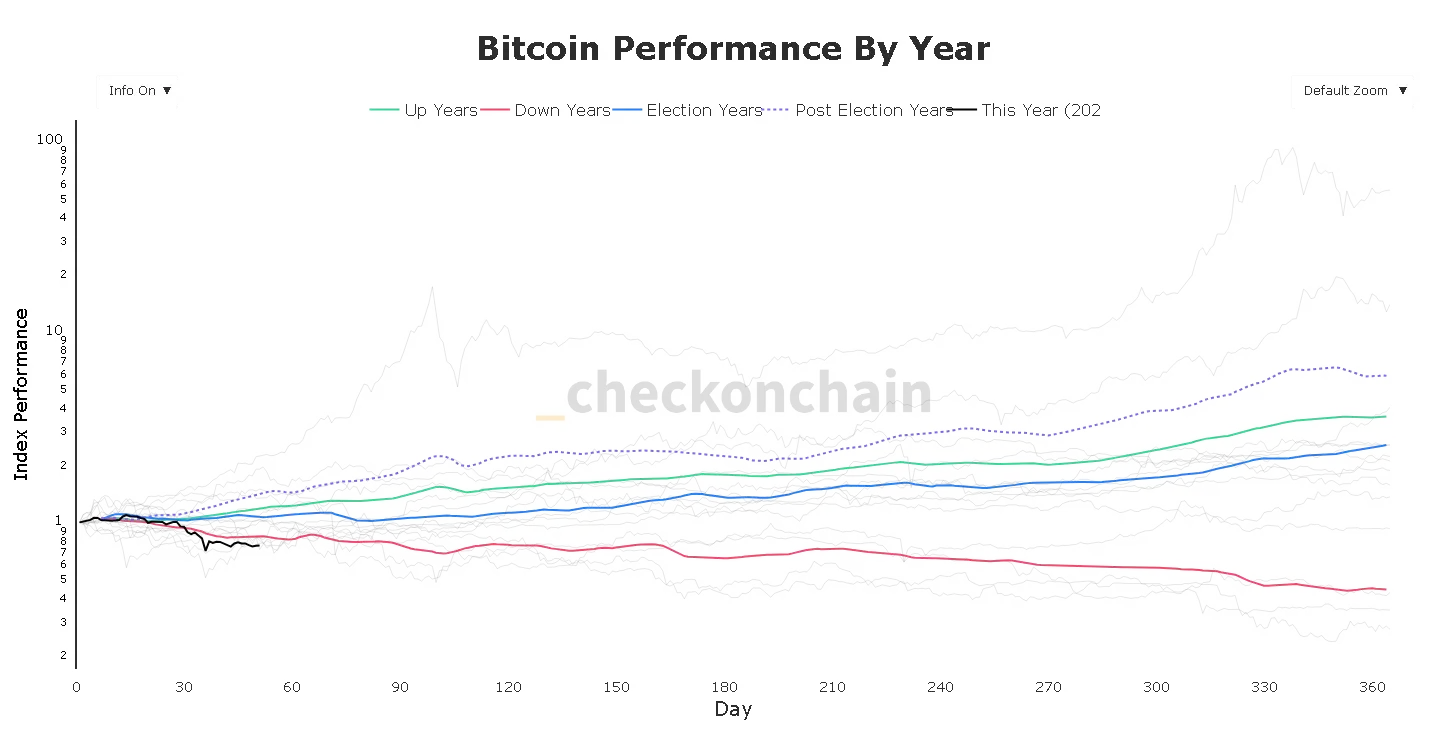

Bitcoin’s price has fallen more than 22% in 2026, marking its weakest start to a financial year on record, according to checkonchain data.

- Data showed Bitcoin’s price is on track for a five-month decline, which would mark its longest losing run since 2018–19.

- Historical patterns, including typical post-election strength and January-February reversals, have not held this year either.

- The cryptocurrency is down roughly 50% from its October peak and has fallen over 22% so far this year.

Bitcoin (BTC) is enduring its worst opening stretch to a financial year, shedding more than 22% so far in 2026 and roughly half its value since October’s peak, even as it climbed back above $68,000 on Friday morning.

According to data from checkonchain, a typical down year has an average index reading of 0.84, whereas Bitcoin is currently at 0.77 – lower than the average of previous crypto slumps.

The 22% fall in Bitcoin’s price this year follows a 17% decline in 2025, which was a post-election year. This marks another pivot from earlier trends, where post-election years have been the top-performing on average, according to data.

Bitcoin Price Trends Break Historical Patterns

CoinGlass data showed this is also the first time Bitcoin is on track to log back-to-back losses with a 10% dip in January, followed by a 13% loss so far in February. Historically, if Bitcoin traded lower in January, it picked up in the following month and vice versa.

Bitcoin’s also on track for a five-month decline, which would mark its longest losing run since 2018–19, when prices dropped for six consecutive months from August 2018 through to January 2019.

Sentiment Turns Cautious

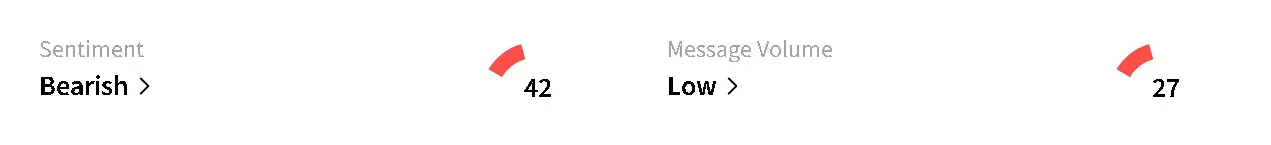

Bitcoin’s price was up nearly 2% in the last 24 hours, climbing to around $68,100. On Stocktwits, retail sentiment around the apex cryptocurrency continued to trend in ‘bearish’ territory over the past day, accompanied by ‘low’ levels of chatter.

Some users on the platform questioned Bitcoin’s narrative as a hedge against inflation.

While others quipped that Bitcoin is unlikely to bounce back anytime soon.

The ‘fear’ sentiment in the crypto market has been growing, with gold bull Peter Schiff repeating calls of Bitcoin’s price falling to $20,000 and Senator Elizabeth Warren asking Washington not to bail out any “crypto billionaires.”

The Fed’s hawkish comments about a potential interest rate hike being on the table are also weighing on the macro environment. Meanwhile, the market structure bill to push the CLARITY Act forward remains stalled with a month-end deadline looming over crypto and bank executives to finalize a deal.

Read also: White House Takes Reins In Crypto-Bank Stablecoin Talks – Rewards Allowed But Penalties Proposed For Evasion: Report

For updates and corrections, email newsroom[at]stocktwits[dot]com.<