Strive Asset Management CEO Matt Cole said Bitcoin looks undervalued relative to gold based on technical indicators.

- Bitcoin’s price fell more than 6% in the past 24 hours, briefly dipping near $81,000 before rebounding toward $82,500.

- However, Cole noted Bitcoin is trading near a level that previously marked a major top in 2017.

- He added that Bitcoin’s weekly RSI is oversold and the price is below its 200-week moving average, supporting a bullish case for the apex cryptocurrency.

Strive Asset Management (ASST) CEO Matt Cole said on Thursday that Bitcoin (BTC) looks cheap right now when compared to gold based on the underlying technical signals.

“Bitcoin is starting to scream deep value and potential support on multiple levels vs gold,” he wrote in a post on X.

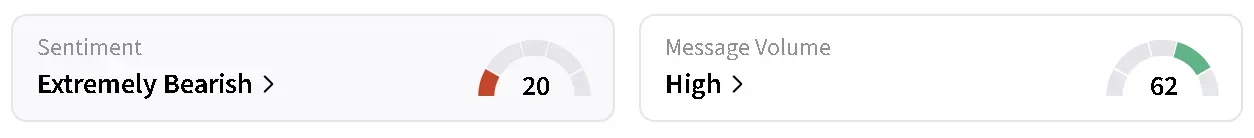

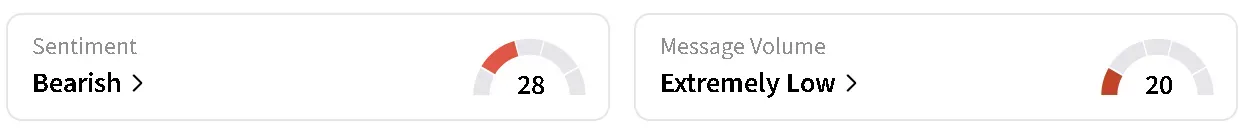

Bitcoin’s price plunged 6.3% in the last 24 hours, currently sitting at around $82,500 – recuperating from an intra-day low of around $81,000. On Stocktwits, retail sentiment around the apex cryptocurrency remained in ‘extremely bearish’ territory, while chatter rose to ‘high’ from ‘normal’ levels over the past day.

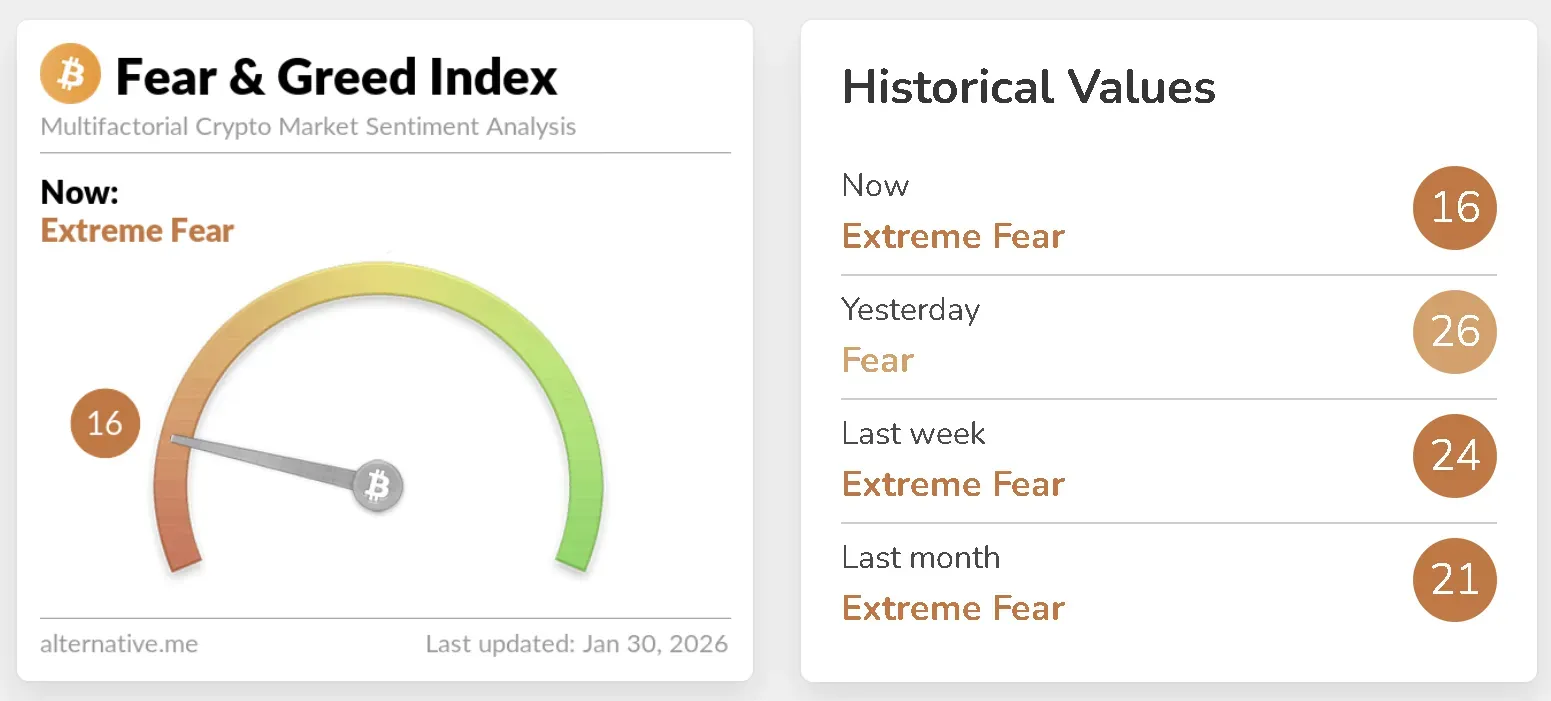

Even the Bitcoin Fear and Greed Index shaved off 10 points, falling to ‘extreme fear’ from the ‘fear’ zone in the last 24 hours.

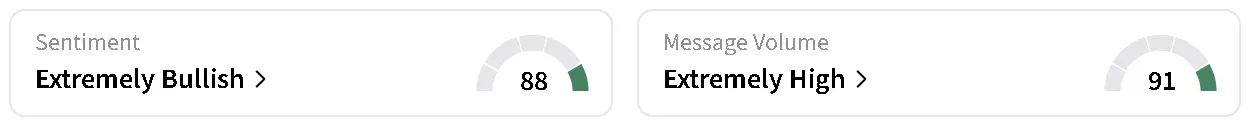

Meanwhile, gold’s price also dipped on the day, down 3.6% to around $5,100 per troy ounce. The SPDR Gold Shares ETF (GLD) edged 0.22% higher in overnight trade, with retail sentiment in ‘ extremely bullish’ territory and chatter at ‘extremely high’ levels.

Strive CEO Remains Bullish On Bitcoin

Despite the lackluster sentiment, Cole is bullish on Bitcoin. The Strive CEO said that Bitcoin’s price is currently sitting near a level that acted as a major top in 2017, adding that Bitcoin’s weekly relative strength index (RSI) is in oversold territory and the price is sitting below the 200-week moving average (WMA) – all signals that Bitcoin’s bottom may be near.

The technical indicators, combined with Bitcoin’s historically strong fundamentals and the dollar’s current weakness, frame a bullish case for the apex cryptocurrency, according to Cole.

The Invesco DB US Dollar Index Bullish Fund (UUP) has fallen 1.48% so far this year, while the WisdomTree Bloomberg U.S. Dollar Bullish Fund (USDU) is down nearly 2%. Meanwhile, Bitcoin’s price has declined around 3.5% so far this year.

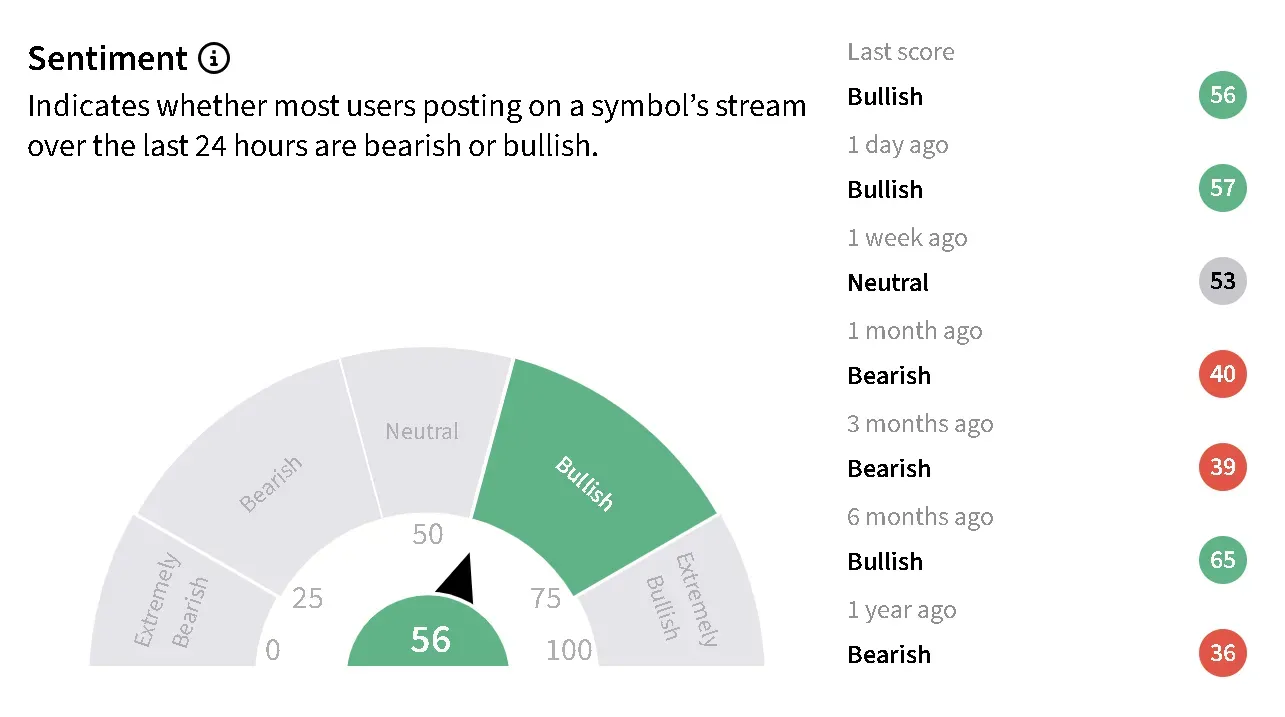

Retail sentiment around UUP on Stocktwits trended in ‘bullish’ territory over the past day, accompanied by ‘extremely high’ levels of chatter.

Why Does Strive Care About Bitcoin?

The Vivek Ramaswamy-backed firm pivoted to a Bitcoin treasury reserve strategy in May last year. Strive’s Bitcoin stash ballooned to over 13,000 BTC, valued at around $1 billion, after the company’s merger with Semler Scientific earlier this month.

On Wednesday, the company announced it had bought another 333.9 Bitcoin and reduced most of Semler’s debt, with plans to retire the entire amount by April.

ASST’s stock edged 0.09% lower in overnight trading, after clocking a loss of over 2% in the regular session following Bitcoin’s crash. Retail sentiment around the stock has trended in ‘bearish’ territory for nearly a month now.

Read also: Pro-Bitcoin El Salvador President Bukele Is Buying The Dip In Gold Too, Just In Case

For updates and corrections, email newsroom[at]stocktwits[dot]com.<