Cardano led losses in the altcoin sector, as Bitcoin sunk amid $242 million in liquidations.

- Over the last 24 hours, $242.5 million worth of crypto bets were wiped out.

- Bitcoin and Ethereum accounted for the majority of liquidations as prices fell..

- Cardano, Solana, and Dogecoin performed the worst, as their higher-beta positioning was reduced.

Long liquidations kept Bitcoin (BTC) near $87,000 on Monday, with analysts saying the move reflects consolidation and relative positioning rather than a trend shift.

Bitcoin on Monday evening was trading at an approximate value of $87,235, down over 3% in the past 24 hours. As per CoinGlass data, Bitcoin saw nearly $82.1 million in liquidations, with the majority in long positions. On Stocktwits, retail sentiment around Bitcoin was ‘bearish’ territory over the past day, with chatter changing from ‘low’ to ‘normal’.

Global Money Supply Renews Bitcoin's Bull Case

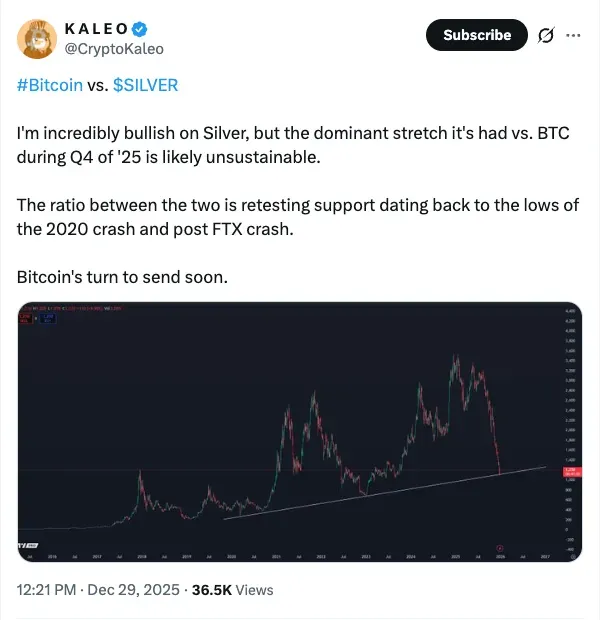

Analysts say Bitcoin is still in a consolidation phase, and that market structure and relative positioning are much more important than short-term price action. Silver’s recent outperformance against Bitcoin might be overstretched with the BTC-silver ratio retesting long-term support levels established after the 2020 crash and the post-FTX lows, meaning that the scales could tip back towards favoring Bitcoin, according to CryptoKaleo.

However, some experts are revisiting the global M2 liquidity thesis, believing that new highs in the money supply could eventually support Bitcoin, even as the price remains rangebound around $86,000.

Bitcoin typically defies crowd expectations, said Santiment analyst on X. In recent months, anxiety has correlated with price rebounds, while optimism has correlated with pullbacks, they noted. The analyst added that Bitcoin sentiment has become cautiously bullish again near $87,000, suggesting a market that may confront near-term resistance before breaking out.

Altcoins Lag As Leverage Resets

Ethereum (ETH) underperformed relative to BTC, opening Monday night at approximately $2,925, which represents a 2.4% drop over the preceding 24 hours. A total of roughly $56.4 million in ETH was liquidated today. The predominance of long positions in the liquidations indicates continued de-risking across all leveraged ETH holdings, as the price of ETH remains unstable. On Stocktwits, retail sentiment around Ethereum dropped from ‘bearish’ to ‘extremely bearish territory’ over the past day, accompanied by ‘low’ levels of chatter.

TRON (TRX) was trading at approximately $0.285 with a 0.3% decrease over the past 24 hours. Liquidation remained at low levels. On Stocktwits, retail sentiment around Tron rose from ‘extremely bearish’ territory to the ‘bearish’ zone over the past day, with ‘low’ chatter levels.

Binance Coin (BNB) was the relative outperformer, with a 2% loss to $848 over the last 24 hours. Liquidations were subdued, indicating selling was more spot-driven than leverage-led. Retail sentiment on BNB changed from ‘neutral’ to ‘bullish’ territory over the past day on Stocktwits, accompanied by ‘normal’ levels of chatter.

Ripple’s XRP (XRP) was trading around $1.85, a roughly 2.3% decline in the last 24 hours. Liquidations were fairly limited relative to BTC and ETH, clocking in at $3.7 million with longs accounting for the majority of the activity. Retail sentiment on Stocktwits dropped from ‘bearish’ to ‘extremely bearish’ territory over the past day, with chatter levels changing from ‘low’ to ‘normal’ levels.

Dogecoin (DOGE) was down about 2.9% and was trading at $0.122, adding to the losses. DOGE saw nearly $2.4 million in liquidations, with pressure on the long side, suggesting that meme sector leverage is still getting washed out. On Stocktwits, sentiment remained in ‘bearish’ territory over the past day, with chatter levels changing from ‘low’ to ‘normal’ levels.

Solana (SOL) underperformed large-cap counterparts, dipping by 4.8% to around $122.6. Liquidations stood at over $10 million, with more long positions being wiped out. On Stocktwits, the retail sentiment around Solana dropped from ‘bearish’ to ‘extremely bearish’ territory over the past day. Chatter around the coin dropped from ‘normal’ to ‘low’ levels.

Cardano Leads Losses In Altcoin Sector

Cardano (ADA) was one of the weakest major coins, falling more than 7% to a push towards $0.35. Liquidation data flashed an above-the-waterline sign on the long side, in line with broader altcoin risk-off price action. However, on Stocktwits, retail sentiment regarding ADA remained in ‘bullish’ territory over the past day, with chatter increasing from ‘normal’ to ‘high’.

The market was leveraged for a long reset, with total crypto liquidations standing at $242.5 million. The unwind has the markets thinly occupied, but still, analysts point out that the market is vulnerable to macro and liquidity signals.

Read also: Bitcoin Could Respond To Silver’s Breakout, Analyst Notes

For updates and corrections, email newsroom[at]stocktwits[dot]com<