With liquidation levels relatively low, hitting $160.35 million, the market anticipates a new high for Bitcoin in 2026.

- Bitcoin's rise to $89,000 was prompted by short liquidations, indicating a late-session squeeze rather than long capitulation.

- Analysts think Bitcoin's long-term consolidation mimics silver's breakout pattern, predicting a stronger directional move.

- Although Solana was up 3.7% in the last 24 hours, Cardano’s retail sentiment on Stocktwits remained in ‘bullish’ territory over the past day.

Bitcoin (BTC) climbed back to the $89,000 mark from its intra-day low of $87,400, as short liquidations caused a wide derivatives flush on Sunday night. Analysts believe that the market may be reaching a structural turning point, especially as gold and silver hit new highs last week.

Bitcoin (BTC) was trading around $89,000, edging up 1.4% in the last 24 hours. CoinGlass data indicated that nearly $28 million of BTC was liquidated, with shorts accounting for roughly $25 million and longs accounting for about $3 million. A $3.86 million BTC/USDT position on Binance was the biggest single liquidation. This suggests that a late-session squeeze rather than folding on the long side. On Stocktwits, retail sentiment around Bitcoin remained in a ‘bearish’ zone, with ‘low’ levels of chatter over the past day.

Bitcoin Could Follow Silver’s Breakout Playbook

Analysts consider the positioning reset to be more essential than the short-term price rebound. On X, TechDev_52 said that Bitcoin may be reaching the finish line of a long consolidation phase, indicating that the market is prepared for a major directional move likely following gold and silver’s rally. On Friday, spot gold reached $4,540 an ounce, while silver reached an intra-day high of over $83 an ounce for the first time since 1979 on Sunday night, as per TradingView.

On Stocktwits, iShares Silver Trust (SLV) was the top trending ticker on Sunday night, with retail sentiment in the 'extremely bullish' territory, with 'extremely high' levels of chatter over the past day.

Echoing this sentiment, CryptoRUs, a key opinion leader, said on X that, similar to silver's last breakthrough pattern, when prices went sideways for a long time until sellers ran out of steam and momentum shifted upward.

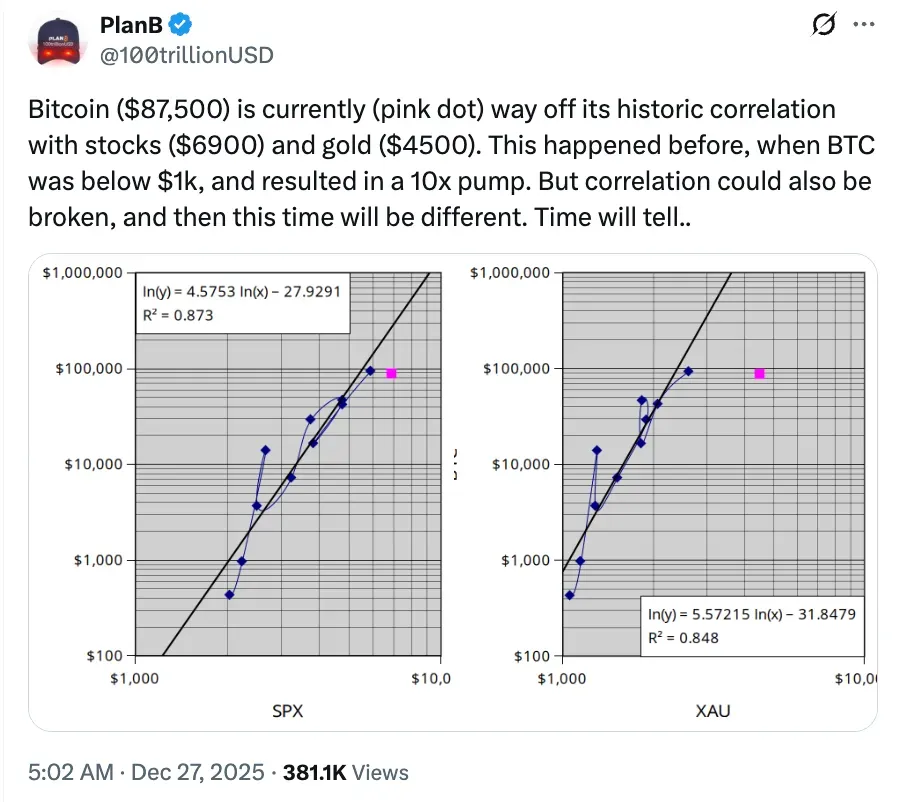

While warning that such signals also carry more uncertainty rather than promises, popular crypto analyst PlanB highlighted that Bitcoin's present divergence from its historical association with equities and gold has preceded significant upward surges in the past.

Shorts Get Wiped As Risk-On Tone Returns

Ethereum (ETH) traded near $3,000, up about 1.8% on the day. ETH led liquidation flows, wiping out around $28.6 million, with shorts at $23.1 million and longs at $5.5 million, supporting the idea that traders leaned into resistance and were driven out as prices stabilized. On Stocktwits, retail sentiment around Ethereum remained in the ‘bearish’ zone. However, chatter around it dropped from ‘normal’ to ‘low’ levels over the past day.

Solana (SOL) performed better than most altcoins, rising around 3.6% to trade close to $129. As leverage reset, Solana witnessed over $10.3 million in liquidations, most of which were short-driven and consistent with momentum-led purchasing. On Stocktwits, retail sentiment around Solana remained in the ‘bearish’ zone. However, chatter around it was up from ‘low’ to ‘normal’ levels over the past day.

With liquidations accounting for almost $1.4 million, Ripple’s native token XRP ( XRP) was trading close to $1.89, up about 1% over the last 24 hours. On Stocktwits, retail sentiment around XRP remained in the ‘extremely bearish’ zone over the past day, accompanied by ‘low’ levels of chatter.

Dogecoin (DOGE) increased 1.9% to $0.126, maintaining its place in the meme-sector. The meme token saw a total of around $1.36 million in liquidations, mostly from short sellers. On Stocktwits, retail sentiment around DOGE changed from ‘neutral’ to a ‘bullish’ zone over the past day, accompanied by ‘low’ levels of chatter.

Binance Coin (BNB) gained close to 2.8% and was trading at roughly $865, while liquidation activity remained low under $726,000, suggesting spot-led gains. On Stocktwits, retail sentiment around BNB remained in the ‘neutral’ zone, accompanied by ‘normal’ levels of chatter over the past day.

Cardano (ADA) was up around 1.6% to $0.376, with less than $1 million in liquidations, indicating gradual risk-taking rather than a breakout effort. On Stocktwits, retail sentiment around ADA remained in the ‘bullish’ zone, accompanied by ‘normal’ levels of chatter over the past day.

TRON (TRX) climbed higher at roughly $0.286, with little liquidation activity, with only $2,361 in shorts and $11,600 on long, indicating very low speculative leverage. On Stocktwits, retail sentiment around TRX remained in the ‘extremely bearish’ zone, accompanied by ‘low’ levels of chatter over the past day.

Total crypto market liquidations reached $160.35 million, as the market awaits a new high for Bitcoin in 2026.

Read also: Bitcoin Miners Are Moving Pre-Market Even As Crypto Prices Hold Firm

For updates and corrections, email newsroom[at]stocktwits[dot]com<