Despite a 15% decline in shares this year, Bharat Forge’s steady Q4 performance and global expansion moves have caught analysts' attention.

Bharat Forge shares slipped despite a steady show in March quarter (Q4 FY25) earnings.

SEBI-registered advisor Financial Sarthis views Bharat Forge’s Q4 results as a mix of steady performance and strategic expansion.

On a standalone basis, the company reported revenue of ₹2,163 crore and a profit of ₹345 crore.

The board recommended a final dividend of ₹6 per share for FY25, reflecting confidence in ongoing profitability.

Strategically, Bharat Forge’s subsidiary acquired a 25% stake in Italy’s Edgelab S.p.A., an innovative player in marine robotics, signaling a push into new technology domains and international markets.

Additionally, the proposed 100% acquisition of AAM India Manufacturing Corp demonstrates the company’s intent to strengthen its manufacturing capabilities.

From a technical perspective, Financial Sarthis notes that a close above ₹1,138 would confirm both a range and long-term trendline breakout, potentially setting the stage for a rally towards ₹1,200.

They identified an immediate support zone in the ₹1,075–₹1,080 range, providing a cushion for the stock in the near term.

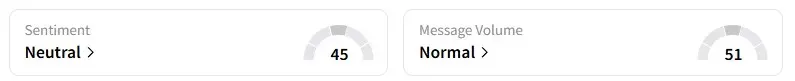

Data on Stocktwits shows that retail sentiment remains ‘neutral’ on this counter.

Bharat Forge shares have fallen 15% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<