As the CLARITY Act negotiations progress, Bessent cautioned that crypto "nihilists" oppose oversight and framed regulation as essential to U.S. financial leadership.

- As lawmakers move forward with the CLARITY Act, Treasury Secretary Scott Bessent warned that a "nihilist" faction within the cryptocurrency lobby prefers no regulation.

- Citing China's blockchain experiments in Hong Kong as a reminder, Bessent pointed out that it was urgent for the U.S. to lead in the global race of digital finance.

- As digital currency integrates with traditional finance, lawmakers have raised concerns about crypto tax compliance, to which Bessent stated that the Treasury pushes to strike a balance between safety, soundness, and innovation.

U.S. Treasury Secretary Scott Bessent went after what he called a "nihilist" group in the crypto industry on Thursday during his testimony before the Senate Banking Committee.

At the Senate Banking Committee meeting, Bessent said that rebelling against regulation could hurt the U.S.'s position as a leader in global finance, while lawmakers continue to work on the Digital Market Structure Clarity bill (CLARITY Act).

Bessent said, "There seems to be a nihilist group in the industry that prefers no regulation over this very good regulation." He also said that opposing oversight could hurt the industry's long-term credibility and stability. Democratic Senator Mark Warner, one of the bill's main negotiators, agreed to Bessent, saying, "Amen, brother."

US Needs To Beat China In Crypto Race

During the same meeting with Senator Cynthia Lummis, Bessent brought up China's testing of digital assets in Hong Kong's sandbox as a reminder that other countries are also looking to test alternative financial assets. To Bessent, the Treasury sees any resistance to regulation as a strategic risk.

He said, “There are lots of rumors of Chinese digital assets that may be backed by something other than the RMB, perhaps gold base. We haven’t seen that they have a very large sandbox in Hong Kong, and HKMA is actively traveling the world, looking at different mechanisms. So I would not be surprised.”

Lawmakers were also concerned about how digital assets might work with the traditional banking system, especially how deposits might change at smaller banks if crypto-linked products become more common in financial services. Bessent replied that the administration is trying to find a balance between “safety, soundness, and innovation”. He pointed to past bipartisan efforts as examples of how crypto oversight could change in the future.

On Crypto Taxation

The meeting also discussed how taxes would be handled for digital assets, like whether current rules make it harder to report small transactions and capital gains. Bessent said that Treasury officials are willing to speak to the Office of Tax Policy about de minimis thresholds and the real-world problems of figuring out how to calculate capital gains on Bitcoin transactions.

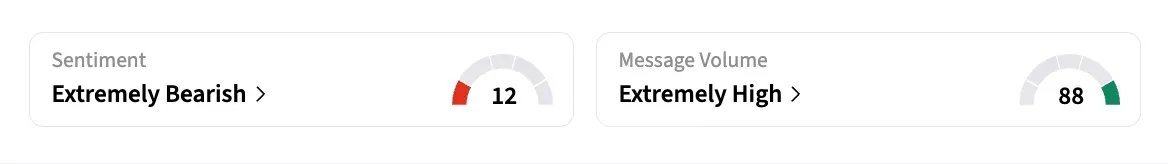

Bitcoin’s price fell to $65,030.20, down by 9.25% in 24 hours. On Stocktwits, retail sentiment around Bitcoin remained in ‘extremely bearish’ territory, while chatter levels remained ‘extremely high’ over the past day.

Bessent further said that the industry needs clear rules from the government to grow within the U.S. financial system. “We have to get this clarity act across the finish line,” said the Treasury head, “And any market participants who don't want it should move to El Salvador.”

According to him, companies that want to do business in the U.S. have to accept federal oversight along with market freedoms.

Read also: Bitcoin, Ethereum Get Rekt In Historic $2.6B Liquidation Bloodbath

For updates and corrections, email newsroom[at]stocktwits[dot]com<