While consolidation at ₹210 is possible, a decisive break beyond that point cannot be ruled out, the analyst said.

Bajaj Consumer Care extended its run on Wednesday, building on the 20% surge seen the day before.

This came after the company announced the appointment of Naveen Pandey as the managing director. Pandey will succeed Jaideep Nandi, whose five-year term concludes on June 30.

At the time of writing, Bajaj Consumer Care stock was up 2.8% at ₹208.5.

From a technical perspective, the stock has recently bounced back from a strong support zone around ₹150, signaling renewed investor confidence, observed SEBI-registered analyst Sameer Pande.

While the Relative Strength Index (RSI) is currently close to 48, indicating neutral momentum, Tuesday’s price action and surge in volumes following the appointment reflect a positive shift in sentiment.

However, the stock faces key resistance levels around ₹210 and then at ₹260, which could act as hurdles in the near term.

On the weekly chart, the stock has already gained over 20%. If this momentum sustains, further upside could follow. Pande noted the ₹180–₹170 zone as a point for fresh entries.

On the daily chart, strong volumes combined with a reversal from support indicate growing investor interest and a potential continuation of the uptrend.

While the momentum looks healthy, there is a possibility of sideways movement in the short term if the stock consolidates below ₹210, the analyst said.

For safer long trades, Pande said new entries can be made either on a decisive breakout above ₹210 or on dips toward the ₹180–₹170 accumulation zone.

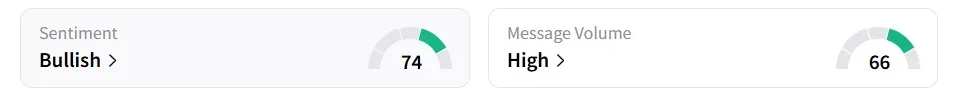

Retail sentiment on Stocktwits turned ‘bullish’ from ‘neutral’ a day earlier, amid ‘high’ message volumes.

Year-to-date, the stock has gained 7.6%.

For updates and corrections, email newsroom[at]stocktwits[dot]com<