The iPhone maker has reportedly accelerated development of AI-powered smartglasses, an AI wearable device, and new AirPods with cameras and AI features.

- Apple plans to debut its smartglasses, which would compete with Meta's and Snap's, in 2027.

- Apple is hosting a special event on Mar. 4, where it is expected to release low-cost MacBooks and iPhone 17e.

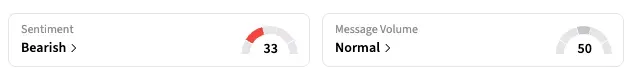

- Although shares jumped on Tuesday, Stocktwits sentiment remains in the ‘bearish’ zone.

Apple, Inc. is reportedly accelerating the development of a trio of AI-powered consumer gadgets that would see it enter turfs dominated by rival tech companies like Meta, Snap, and OpenAI.

Three AI Gadgets In Pipeline

The iPhone maker is developing an AI wearable, according to recent leaks, which could be an AirTag-sized pendant with cameras that can be pinned to a user’s shirt. Additionally, Apple is developing AI-powered smartglasses, code-named N50, which would compete with Meta's Ray-Bans and Snap’s Spectacles (both Meta and Snap are working on their next-gen offerings).

Bloomberg reported that Apple plans to begin production of smartglasses in December, ahead of a public release next year. A third product is AirPods with a camera and AI capabilities.

All three devices would have deep Siri integrations and be linked to the user’s iPhone, according to the report. The news break sent Apple shares 4% higher intraday before they ended 3.2% up at $263.88 – a welcome rebound after two straight days of losses.

Other Catalysts

Earlier this week, Apple announced a “special Apple Experience” event on March 4, at which it is widely expected to unveil new low-cost MacBooks and the iPhone 17e.

The company also released iOS 26.4 beta for developers; the new iPhone software includes video podcasts, Apple Music playlists, and other features but leaves out Siri enhancements.

Stock Move, Retail Sentiment

Apple has been caught in a tech industry-wide selloff amid fresh fears of AI-driven disruption, particularly for software companies. Apple shares shed 8% last week.

In a recent note, Wedbush said Apple’s dip is overblown, and the company remains on course to unveil its next-generation AI features by summer. Apple’s repeated delays in shipping AI functionality that has long been available on competing smartphones and laptops are weighing on the company’s stock.

Analysts are also lauding Apple, which has stood out by forecasting only a modest increase in capital expenditures this year, even as Big Tech peers have planned significantly higher spending than last year.

Still, the Stocktwits sentiment for AAPL remained ‘neutral’ as of early Wednesday, unchanged over the past week.

Berkshire Trims Stake

Meanwhile, Berkshire Hathaway disclosed that it trimmed its Apple position in the December quarter by 4.3% to $61.96 billion. Apple remains Berkshire's top portfolio company, comprising 22.6% of all of the firm’s holdings.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<