The beat-and-raise quarter saw Analog Devices navigate a tumultuous geopolitical environment, with Benchmark underscoring that the company delivered improvements across business segments.

Shares of Analog Devices Inc. (ADI) will be in focus as markets open on Monday. The stock received a flurry of price target hikes after its first-quarter earnings beat.

Analog Devices posted earnings per share (EPS) of $1.63 in Q1, beating Wall Street estimates of $1.54. Revenue surpassed expectations, too, coming in at $2.42 billion, ahead of the estimated $2.36 billion.

However, on a year-on-year basis, Analog Devices’ EPS and revenue both edged lower, from $1.71 and $2.50 billion, respectively.

The Q1 beat sparked a flurry of price target hikes across brokerages, with analysts underscoring their bullish outlook by laying out Analog Digital's long-term growth prospects.

The beat-and-raise quarter saw Analog Devices navigate a tumultuous geopolitical environment, with Benchmark underscoring that the company delivered improvements across business segments.

Analysts at Benchmark and Wells Fargo note that ADI is set to return to its long-term growth model of 7% to 10% this year, while TD Cowen noted that the company is at the front of a cyclical recovery.

FinChat data shows the breakdown of the 29 brokerage recommendations for the ADI stock: 16 ‘Buy’ ratings, two ‘Outperform’ ratings, and 11 ‘Hold’ ratings.

The average price target for the ADI stock is $250.77, implying an upside of nearly 5% from Friday’s close.

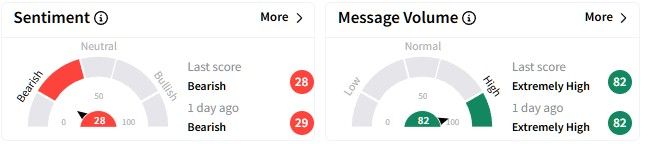

However, retail sentiment on Stocktwits around the ADI stock told a different story – it hovered in the ‘bearish’ territory, even as message volume rose to ‘extremely high’ levels.

On a trailing twelve-months (TTM) basis, ADI’s price-to-earnings (PE) ratio stood at 76.3.

In comparison, here’s how some of its rivals fare: Texas Instruments at 38.8, Microchip Technology at 107.8, and NXP Semiconductors at 25.3, according to FinChat data.

ADI’s stock has gained over 12% year-to-date (YTD), while its one-year returns stand at over 26%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<