Wedbush upgraded AMC to Outperform, citing stronger film releases, reduced 2026 debt risks, and international expansion.

AMC Entertainment’s (AMC) stock jumped on Friday after receiving a bullish upgrade from Wedbush Securities, citing improving industry conditions and improved financial position, despite broader market weakness.

Wedbush now rates the stock as ‘Outperform’ from the previous ‘neutral’ position, raising its price target from $3 to $4, as per TheFly.

Following the upgrade, AMC Entertainment stock traded 6.6% higher after the opening bell.

The investment firm cited several factors behind the upgrade, including a steadier film release schedule, debt restructuring, and AMC's expanding international footprint.

The company is also believed to be nearing the end of its major equity offerings, which will help alleviate a key source of investor concern.

The brokerage expects AMC to benefit from a more predictable flow of movie releases over the next several quarters. A reliable lineup of films typically translates into more consistent ticket sales, providing greater financial visibility and stability for the company.

Wedbush also noted that AMC has either paid off or extended all debt obligations that were scheduled to mature in 2026.

On July 1, the company reached a major agreement with key creditors to restructure its debt and settle ongoing legal issues. The deal includes $223.3 million in new financing aimed at refinancing 2026 debt.

Additionally, AMC will convert at least $143 million of debt into equity immediately, with the option to convert up to $337 million in total, signaling a major step in its financial overhaul.

This move reduces short-term financial risk and strengthens its balance sheet. According to Wedbush, this development lifts a key overhang from the stock.

It also noted the company’s plans to expand further in the U.K. and European markets, positioning it to capitalize on its portfolio of premium screens – the largest of its kind in North America. Wedbush believes this could help the company gain box office market share in 2025 and 2026.

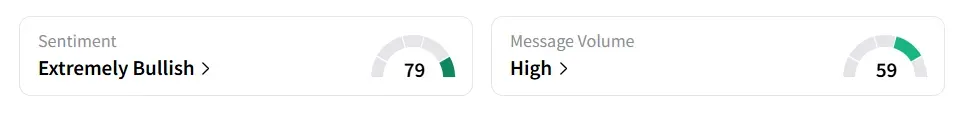

On Stocktwits, retail sentiment around AMC Entertainment improved to ‘extremely bullish’ from ‘bullish’ a day ago.

AMC Entertainment stock has declined by over 24% in 2025 and by more than 42% in the past 12 months. Its earnings are scheduled for Aug. 1.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<