Treasure Global’s retail chatter surged 2,300% in 24 hours after it entered into a memorandum of understanding with iSynergy Group to strengthen AI infrastructure.

The tech-heavy Nasdaq Composite Index hit a fresh high on Thursday, closing 0.18% higher at 21,057, with earnings providing a boost. Here are the top three tech companies that saw the highest retail chatter on Stocktwits in the last 24 hours.

1. Treasure Global Inc. (TGL): The Malaysia-based tech company saw retail chatter surge 2,300% in 24 hours after it entered into a memorandum of understanding with iSynergy Group to build scalable AI cloud infrastructure in Southeast Asia.

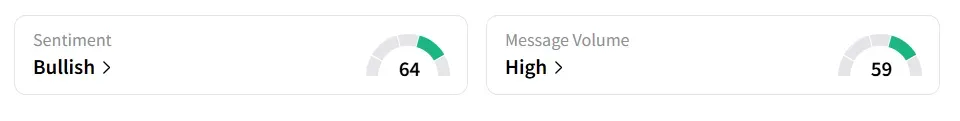

Retail sentiment around the stock improved to ‘bullish’ (64/100) from ‘bearish’ territory the previous day. Message volume shifted to ‘high’ (59/100) from ‘low’ levels in the last 24 hours.

Treasure Global stock traded over 6% higher in Friday’s premarket.

A Stocktwits user expressed optimism about the news.

The two firms intend to work on sourcing and deploying high-performance GPU (graphics processing unit) technologies that are essential to building AI cloud frameworks.

Treasure Global stock has lost over 87% of its value year-to-date and more than 98% in the last 12 months.

2. Paramount Global (PARA): The media giant saw retail message count explode by 503% in 24 hours after the Federal Communications Commission approved its merger with Skydance.

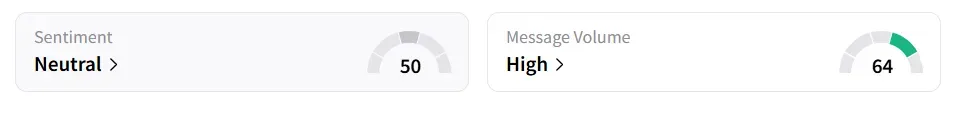

Retail sentiment around the stock improved to ‘neutral’ (50/100) from ‘bearish’ territory the previous day. Message volume shifted to ‘high’ (64/100) from ‘low’ levels in the last 24 hours.

Paramount Global stock traded over 1% higher in Friday’s premarket.

The agreement faced turbulence earlier this year after President Donald Trump criticized Paramount’s CBS News unit, accusing it of political partiality.

3. AST SpaceMobile Inc. (ASTS): The satellite manufacturer experienced a 189% surge in retail message count in the last 24 hours after the company announced a $500 million private offering on Thursday.

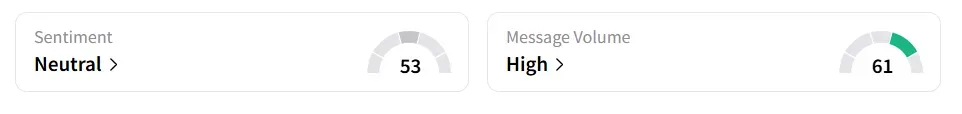

Retail sentiment around the stock remained in ‘neutral’ (53/100) territory. Message volume shifted to ‘high’ (61/100) from ‘normal’ levels in the last 24 hours.

AST SpaceMobile stock traded over 8% lower in Friday’s premarket. The stock has gained over 184% in 2025 and 260% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<