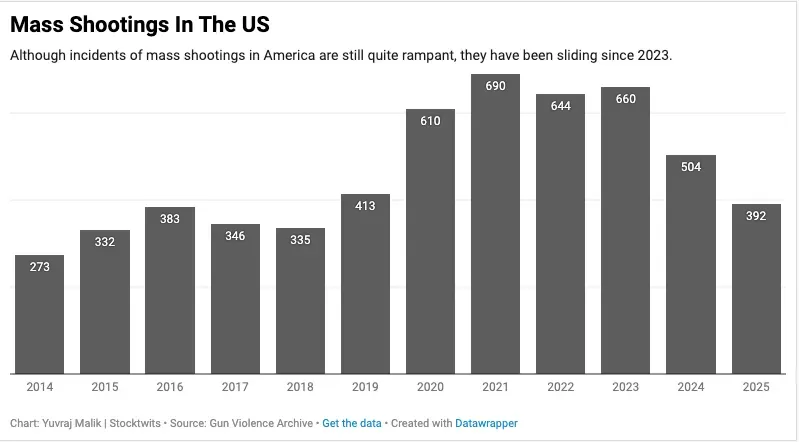

Mass shootings in the U.S., and deaths in such incidents, are at multi-year lows, data show.

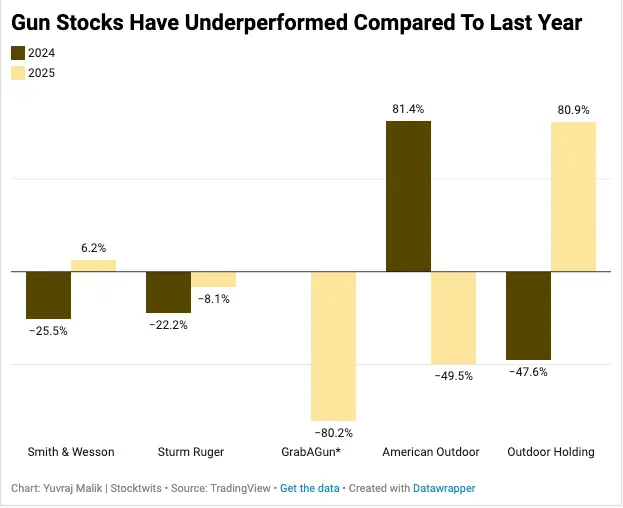

- Gun stocks have largely underperformed this year compared to 2024, with Outdoor Holding emerging as an outlier.

- Smith & Wesson also posted gains, although its sales decline continues amid industry softness.

- Most analysts recommend buying major gun stocks, according to Koyfin.

Despite a high-octane 2025 that followed an assassination attempt on President Donald Trump at the end of last year and the killing of conservative activist Charlie Kirk, this year has been comparatively quieter in terms of gun violence. And, in turn, for the gun stocks.

That said, Smith & Wesson Brands Inc., the iconic U.S. firearms seller, and GunBroker.com parent Outdoor Holding Co. have had a strong run compared to 2024, driven mainly by company-specific initiatives that fueled business momentum.

There have been at least 392 mass shootings in the U.S. so far this year, leaving at least 325 people dead and 1,775 injured, according to the Gun Violence Archive (GVA), a nonprofit organization. The number of shooting incidents is the lowest in seven years. The number of deaths in such incidents is the lowest in two decades, according to the Associated Press database.

Gun stocks typically rally in the wake of mass civic shootings – as seen after Kirk’s assassination – on the perception of a surge in personal security concerns, with heightened demand for firearms translating into gains for the sector. Experts have also pointed out another factor: a fear of stronger gun regulations leading to increased sales.

Stock Moves

Outdoor Holding has been the top gainer with an over 80% year-to-date gain, compared to a 47% decline in 2024 (see chart). The niche e-commerce company is in the midst of a turnaround, marked by revenue growth, aggressive cost cuts, and its first quarterly net profit in more than three years in the September quarter.

The company divested its ammunition manufacturing business for $75 million in April. More recently, it regained full compliance with Nasdaq listing rules and settled an investigation by the Securities and Exchange Commission without a penalty.

Smith & Wesson also pulled in modest stock gains this year, compared to a 25.5% drop last year. Although sales continue to slide amid industry-wide softness, a mix of new product launches, cost reductions, and supportive macro developments – such as the U.S. rescinding a Biden-era rule two months ago that imposed stringent export controls on civilian firearms, ammunition, and related parts – helped lift the stock.

Under the new rule, most pistols, rifles, and non-long-barreled shotguns will still require export licenses, according to the U.S. Commerce Department's Bureau of Industry and Security, or BIS.

All other major gun stocks, including Sturm Ruger & Co., American Outdoor Brands, and the newly listed GrabAGun Digital Holdings, have declined this year. With two major civic shootings happening in recent days — at Sydney’s Bondi Beach and at Brown University in Rhode Island — gun controls, and in turn, gun stocks, could again shoot into the limelight.

On Stocktwits, the retail sentiment was ‘bearish’ for SWBI, AOUT, and PEW, ‘neutral’ for RGR, and ‘bullish’ for POWW. Interestingly, the handful of analysts covering the gun stocks recommend a ‘Buy’ for all the names, with just a single ‘Hold’ rating for RGR, according to Koyfin.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<