In a post on X, Kiyosaki described the U.S. national debt and long-term liabilities as the biggest risk facing investors.

- Kiyosaki said he stopped buying Bitcoin at $6,000, gold at $300, and silver at $60.

- He acknowledged selling some Bitcoin and gold but said he dislikes paying capital gains taxes.

- Kiyosaki said he would buy silver near $74 and gold near $4,000.

Author of “Rich Dad Poor Dad” Robert Kiyosaki said on Thursday that he’s holding off on buying more Bitcoin (BTC), silver, and gold until prices reach new market bottoms. According to him, the bigger risk to the market right now is falling prices, but the mounting debt burden of the U.S.

In a post on X, Kiyosaki framed the U.S. fiscal position as the “bigger problem” facing investors. He noted that the U.S. national debt stands at roughly $38 trillion and that total obligations balloon to $250 trillion when future liabilities tied to programs such as Social Security and Medicare are included.

“The real problem is the Fed, our incompetent leaders, and our criminal banksters who rip us off via our fake dollars,” he wrote.

No More Bitcoin Buys Until Prices Hit Bottom

Kiyosaki stated that he stopped buying silver at $60, Bitcoin at $6,000, and gold at $300. “I have sold some Bitcoin and some gold. I hate selling because I hate paying capital gain taxes,” he wrote, adding that he is now waiting “patiently” for new bottoms in both assets before considering fresh purchases.

Bitcoin’s price fell as low as $60,100 during the session, before rising back up to $65,600 on Thursday night – still down by 6.6% in the last 24 hours. On Stocktwits, retail sentiment around the apex cryptocurrency dropped to its lowest level in a year, slipping further into the ‘extremely bearish’ zone. Chatter remained at ‘extremely high’ levels.

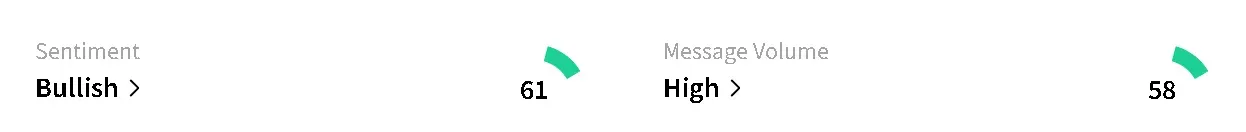

Meanwhile, gold prices were trading at around $4,400 per ounce on Thursday night, up 1.95% over the past day. However, the SPDR Gold Shares ETF (GLD) was down 0.92% after hours, following a dip of 2.66% in regular trade. Retail sentiment around the fund on Stocktwits tumbled to ‘bullish’ from the ‘extremely bullish’ zone over the past day while chatter remained at ‘high’ levels.

Prices of silver jumped 4.4% over the past day to $73.8 on Thursday night. The iShares Silver Trust (SLV) dropped 4.63% in overnight trade, following a plunge of 15.77% in the regular session. Like GLD, retail sentiment around the fund pared to ‘bullish’ from ‘extremely bullish’ territory over the past day. Chatter also decreased to ‘high’ from ‘extremely high’ levels.

‘Rich Dad’ Lessons On Timing And Patience

While Kiyosaki is waiting for Bitcoin and gold to hit lower levels, he said he is prepared to buy more silver if prices reach $74 and gold if prices fall to $4,000. He added that his portfolio currently holds sufficient Ethereum (ETH) but would consider increasing that position later.

“Your profit is made when you buy, not when you sell,” Kiyosaki wrote, reiterating one of the core lessons from Rich Dad Poor Dad. He said he plans to disclose publicly when he begins buying again and warned investors against chasing rallies, repeating another one of his lines that is often cited by traders, “Pigs get fat… hogs get slaughtered.”

Read also: Bitcoin’s Slide Triggers MSTR’s Biggest One-Day Drop In Over A Year – But These Three Crypto Stocks Took a Bigger Hit

For updates and corrections, email newsroom[at]stocktwits[dot]com.<