He said that the First Republic Bank’s fall in 2023 and subsequent acquisition by JP Morgan left a void in consumer-focused private banking.

Robinhood Markets CEO Vlad Tenev said the company aims to become a consumer-focused bank by offering luxury financial services at an affordable price to subscribers of its Gold services.

“Anything that a high net worth individual can get from the private wealth manager or private banker should be available to Robinhood Gold, to a mass market audience, and for just $5 a month,” Tenev said during an interview with Stocktwits.

Robinhood Gold gives users access to Morningstar research reports, level II Nasdaq data, and a 4% annual percentage yield on uninvested brokerage cash, among other features.

The subscribers count for Robinhood Gold jumped 90% year-over-year during the first quarter to hit 3.2 million.

“We're trying to do a financial services luxury at a mass market price, which I don't think has been done before,” Tenev added.

The co-founder of Robinhood said that the fall of First Republic in 2023 and its subsequent acquisition by JP Morgan left a void in consumer-focused private banking.

“There is no consumer-friendly private bank, in our opinion, right now, and certainly not one that has any semblance of a mobile digital strategy,” Tenev said before adding that Robinhood Gold has a “natural place” in the sector.

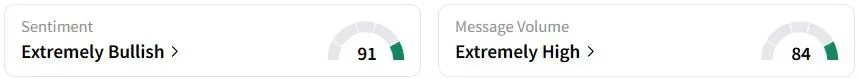

On Friday, retail sentiment on Stocktwits was in the ‘extremely bullish’ (91/100) territory, while retail chatter remained ‘extremely high.’

Tenev also called to expand retail access to private market investments, arguing that current accredited investor rules are outdated and exclusionary.

Robinhood stock has gained 26% year to date (YTD) compared with a 3.8% fall in the SPDR S&P 500 ETF (SPY) and a 5% drop at Invesco QQQ Trust Series 1.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<