Ahead of the 2026-27 Union Budget, companies and consumers anticipate measures to lower prices and increase disposable income. Key proposals include reducing GST on everyday goods to 5% to stimulate spending.

Will the prices of everyday goods decrease? The market and the common people are looking forward to major announcements in the upcoming 2026-27 Union Budget. Leading companies in this sector hope the budget will include measures to reduce the prices of goods and put more money into people's hands.

GST should be reduced; and prices too! The main demand from the market is to reduce the GST rate on everyday items like soaps and cleaning lotions. Currently, many such items have a GST of 18%. If this is lowered to 5%, the prices of goods will decrease, and more people will come forward to buy them, says Sudhir Sitapati, MD of Godrej Consumer Products. This will be a great relief for the family budgets of the middle class.

Rural areas need a boost

Although the urban market is showing signs of recovery, the rural sector still has room for improvement. Companies are demanding the implementation of the following for this:

Job opportunities: More funds should be allocated for rural employment guarantee schemes and agricultural projects.

Money in hand: Changes should be made to income tax or other benefits so that common people have more money to spend.

Small brands: Large companies need policy support to face competition from local brands.

More strength for 'Made in India'

Paritosh Ladhani, Joint MD of SLMG Beverages, expressed hope that the budget will give more emphasis to the 'Atmanirbhar Bharat' scheme to make India a global manufacturing hub. Improving infrastructure like roads and bridges can speed up logistics and reduce costs.

Eco-friendly Packaging

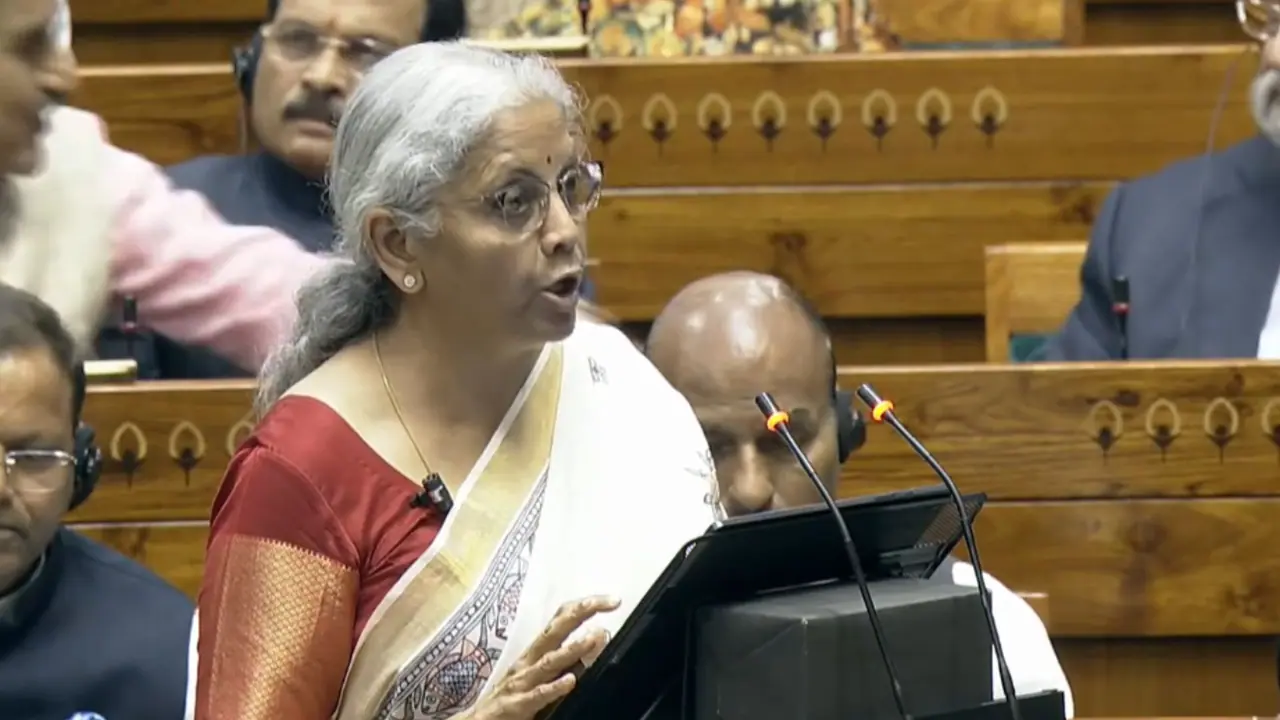

As part of reducing plastic pollution, companies are trying to switch to eco-friendly packaging. However, this is more expensive. The market believes that if companies using eco-friendly materials are given tax exemptions or subsidies, this transition can be accelerated. The country is waiting to see if the Finance Minister's budget speech will have a magic wand to control inflation and increase cash flow in the market. Those in the sector say that if rural revival and tax reforms are implemented, 2026 will be a year of great growth for the market.