Improve your CIBIL score: 4 smart loan moves you should make

Worried about a low credit score affecting your loan application? Don't be! Discover four simple yet effective tips to improve your credit score and increase your chances of loan approval.

17

Low Credit Score? No Worries, Solutions Here

Taking loans is common today. Whether buying a house, a car, or electronics, EMIs are everywhere. But the biggest hurdle is the credit score. If yours is low, banks hesitate to lend.

Add Asianet Newsable as a Preferred Source

27

750+ Score Is Considered Good

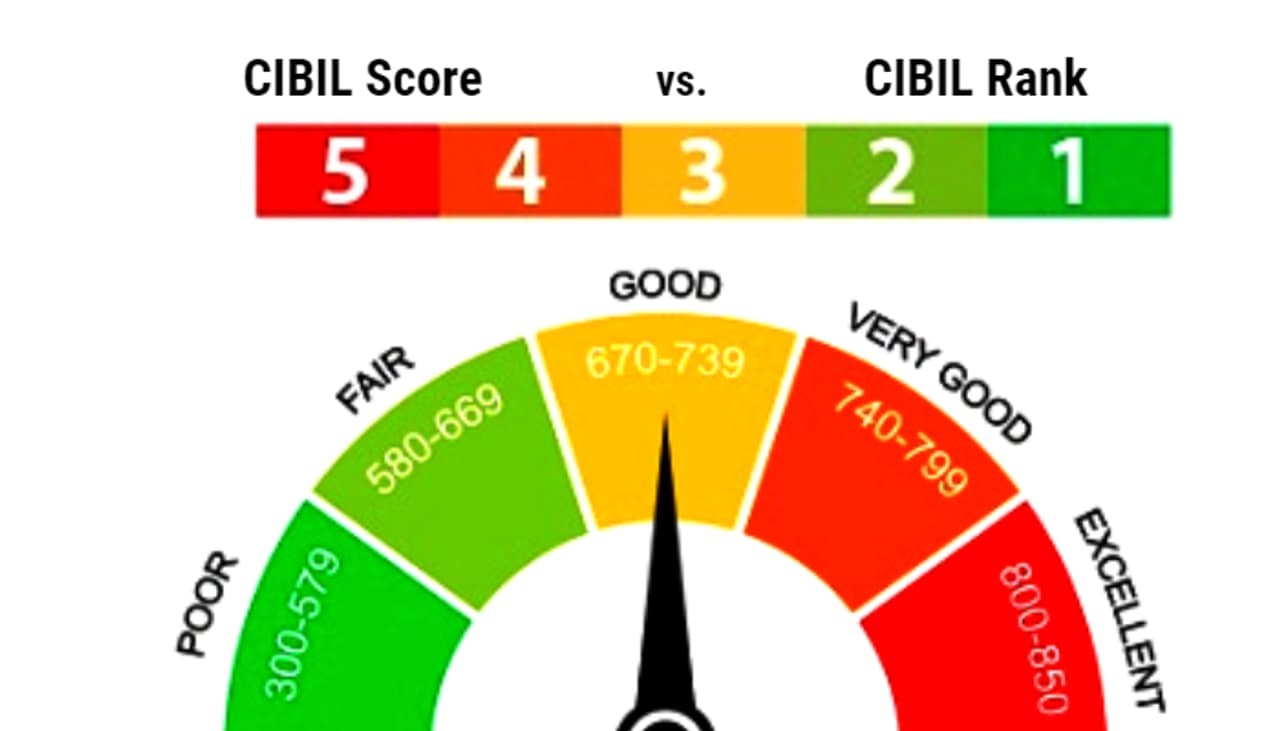

Credit scores range from 300 to 900, and 750+ is generally considered good. If yours is lower, getting a loan can be tough. But don't worry – these four powerful tips can help you improve your score and secure a loan.

37

1. Mind Your Credit Card Limit

Many think using more credit cards improves their score, but the opposite is true. Consistently using 80%-90% of your limit can lower it. Spend within 30% of your limit. Pay your full credit card bill on time, not just the minimum. If you frequently cross the limit, apply for a limit increase.

47

2. Pay EMIs On Time

Timely EMI payment is crucial for a good credit score. Missing even one EMI can drop your score by 50-100 points. Use ECS or auto-debit to stay on track. Set reminders for EMI due dates. If facing financial difficulties, discuss restructuring with the bank – it's better than defaulting.

57

3. Borrow Only When Necessary

Frequent borrowing or applying for unnecessary credit negatively impacts your score. Each application triggers a "hard inquiry" by banks, checking your credit report. Too many hard inquiries lower your score. Plan your loans smartly. Avoid taking new loans until existing ones are paid off. Don't apply to multiple banks simultaneously for loan comparisons. Always evaluate needs and alternatives before borrowing.

67

4. Avoid Short-Term Loans

Short-term loans mean higher EMIs, increasing the risk of default and severely impacting your credit score. Opt for longer loan tenures with smaller EMIs to manage monthly expenses and ensure timely payments.

77

Pro Tips for a Quick Credit Boost

Pay EMIs and credit bills on time. Maintain a high credit limit and low utilization. Balance loans and credit cards. Keep old credit accounts open.

Stay updated with all the latest Business News, including market trends, Share Market News, stock updates, taxation, IPOs, banking, finance, real estate, savings, and investments. Track daily Gold Price changes, updates on DA Hike, and the latest developments on the 8th Pay Commission. Get in-depth analysis, expert opinions, and real-time updates to make informed financial decisions. Download the Asianet News Official App from the Android Play Store and iPhone App Store to stay ahead in business.

Latest Videos