PFRDA has partnered with PB Fintech to launch Pensionbazaar.com, a digital platform to expand pension coverage to the non-government sector. The initiative aims to simplify access to pension products and foster a competitive market for consumers.

PFRDA Partners with PB Fintech for Pensionbazaar.com

The Pension Fund Regulatory and Development Authority (PFRDA) has joined forces with PB Fintech to launch a major initiative aimed at expanding pension coverage beyond government employees through the Pensionbazaar.com platform, marking a significant shift in India's retirement planning landscape.

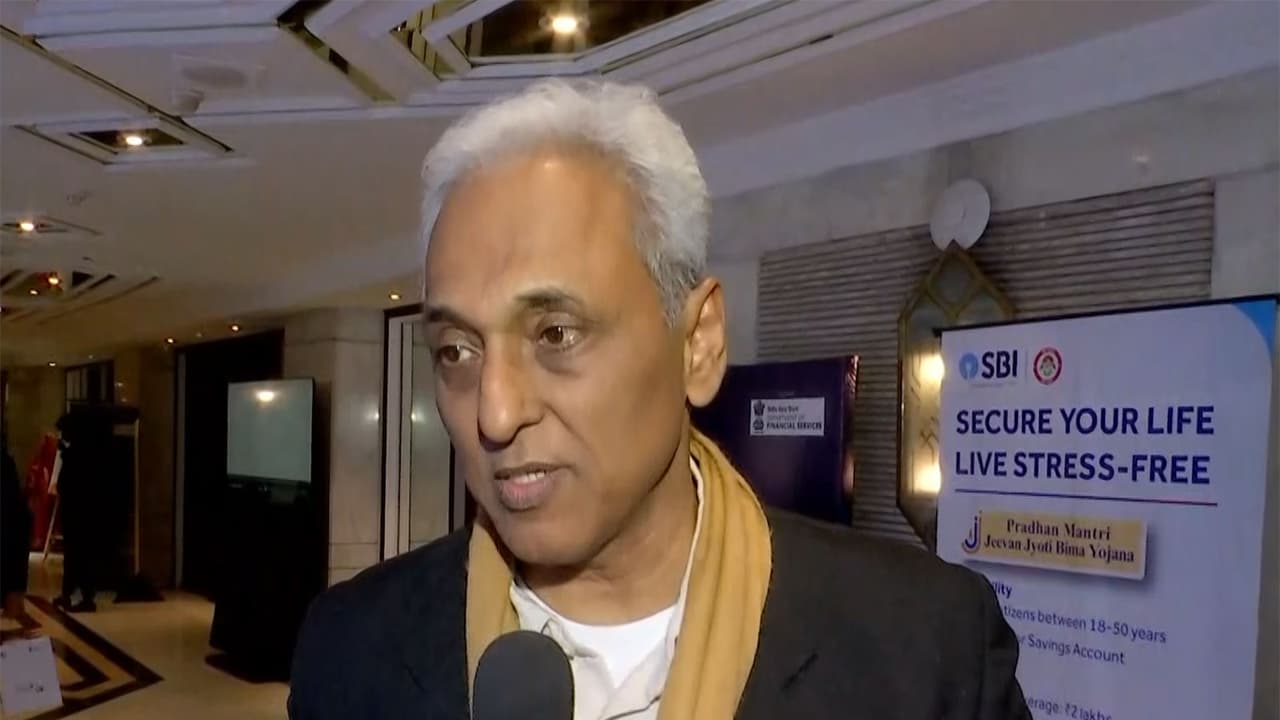

PFRDA Chairperson Sivasubramanian Ramann announced the regulator's strategic pivot toward the non-government segment, emphasising flexible regulations and a phygital distribution model to make pension products more accessible to the general public. "Pension Bazaar is an assurance like Policy Bazaar has given the option to people that, with a click on mobile, they can buy any insurance policy. If we can also provide such a platform to people in pension, then the adoption rate will be increased," Ramann told ANI.

Platform Features and Accessibility

The platform will enable pension funds to partner with Pensionbazaar.com and launch their products, giving people the option to choose from multiple funds based on their preferences. The initiative permits individuals aged 85 or younger to purchase pension policies.

Investment Safety and Oversight

"I can assure that investment through Pension Bazaar will be safe," Ramann emphasised, noting that the regulator conducts quarterly review meetings to ensure pension funds don't misallocate investments. Investors will have access to the top 250 stocks listed on NSE and BSE through the platform.

Committee Formed for Assured NPS Payouts

In a significant development, PFRDA has constituted a high-level committee to formulate guidelines for assured payouts under the National Pension System (NPS). The committee will be chaired by MS Sahoo, founder of Dr. Sahoo Regulatory Chambers and former Chairperson of the Insolvency and Bankruptcy Board of India (IBBI).

"Our act says that there should be a minimum return scheme. There were some efforts in the past to have such a scheme but they were not successful," Ramann explained. "We have to try and make such a scheme which will require some kind of market-based guarantee. We need to see which entity can give us such a guarantee." The committee will deliberate on bringing guaranteed products within the pension framework, after which pension funds will assess the feasibility of implementation.

Future Outlook for the Pension Sector

The PFRDA chief highlighted the sector's evolution, stating that while the industry is currently in the contribution build-up phase, the goal is to transition toward the income generation phase. "Every pension fund wants to give their best scheme to customers," Ramann said, underlining the competitive environment that the new platform aims to foster. (ANI)

(Except for the headline, this story has not been edited by Asianet Newsable English staff and is published from a syndicated feed.)