Banks are taking almost a month to issue cheques. Cheque bounce due to unmatched signature is also becoming an issue. Banks are receiving four to six times higher application for new cheque books daily after demonetisation.

As days are passing by and the end of 50 days of demonetisation is nearing, the ill-preparedness of the government machinery and banks is unfolding itself, and the only question that is ceased to die down is what after 50 days?

When PM Narendra Modi announced demonetisation, it sent shockwaves across the nation, but this shock has been superseded by the following endless RBI notifications, recovery of black money in new notes, deaths in ATMs and banks, and apparent no preparations of the nationalised as well as private banks.

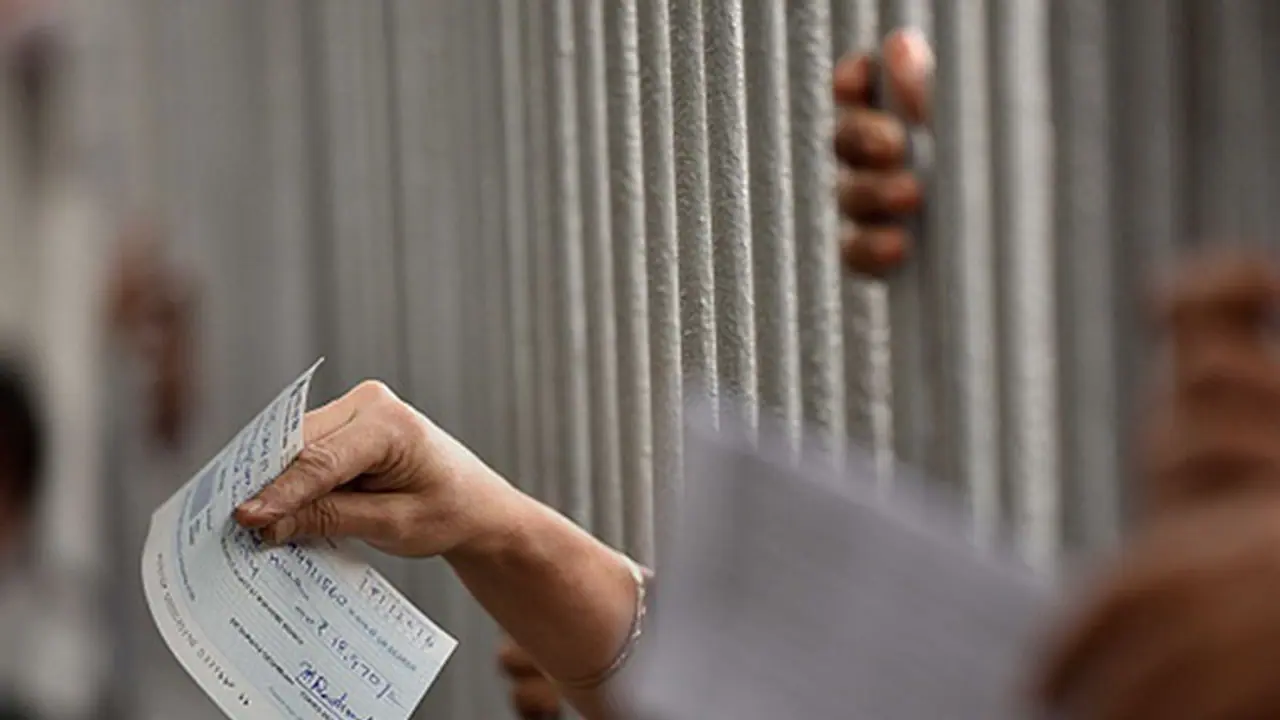

After long queues in front of ATMs, it is issuing of cheque book that is taking unusually longer time due to demonetisation. Earlier, the banks took one week's time to issue the cheque books but now, this time limit has been exceeding a fortnight due to the surge in demand.

Cheques are one of the safest, traditional, and widely used payment methods. Since there is no transaction limit in cheque payment, it is a preferred mode for big transactions after demonetisation. Digital transaction is encouraged by the central government, but technical glitches and transaction limits are still making it difficult for people to do easy and smooth monetary dealings using e-wallets and PoS machines.

This has led to higher number of applications for new cheque books. As compared to before demonetisation, the banks are receiving four to six times higher applications for new cheque books on a daily basis, and now, banks are taking almost a month to issue new cheque books.

The banks are running out of cheque books to issue, and since there is no clarity as to when the country will get out of cash crunch situation, this might lead to bigger problems for the banks.

Another issue faced by the banks related to cheques is cheque bounce due to the mismatched signature. Since many people are using cheques for the first time or using this method after a long time, their signatures are not matching leading to rejected cheques by the banks.

This is also causing havoc for the payee, payer and the banks. Since in the beginning, demonetisation was expected to cause inconvenience for 50 days, this was not a matter of concern, but as there is no sign of the cashless situation becoming normal anytime soon, these issues might cause big troubles for the masses, banks and also to the government.