The remarks were shared on X against a backdrop of strong U.S. growth data.

- The comments came as fresh economic data showed the U.S. economy expanding at its fastest pace in two years in the third quarter.

- Recent government and central bank data highlighted resilient consumer spending and continued strength in business investment.

- Musk linked longer-term economic expansion to increased use of applied AI.

Elon Musk, the world’s richest person, said he expects the U.S. economy to move into a period of double-digit growth within the next 12 to 18 months, pointing to applied AI as a key driver, in a post on X on Wednesday.

Musk said in a post on X that “double-digit growth [for U.S.] is coming within 12 to 18 months,” adding that if applied intelligence is treated as a proxy for economic growth, “triple-digit is possible in about five years.”

Economic Data Provides Backdrop

Musk's comments followed a day of data that showed the U.S. economy expanded at the quickest pace in two years in the third quarter. Gross domestic product (GDP) rose at a 4.3% annualized rate, buoyed by solid consumer spending and steady business policies.

The report was delayed by a government shutdown and showed strength carried through the middle of the year even as consumer confidence was dented in December and factory output was unchanged in November.

AI Investment And Policy Signals

AI data center spending is among several factors cited by Federal Reserve officials, along with consumer spending and fiscal assistance, as bolstering their projections for stronger growth in 2026.

Business investment spending increased at a 2.8% annual rate in the third quarter, lifted in part by spending on computer equipment and data centers to support AI workloads. Policymakers are signaling a more gradual series of interest-rate cuts in 2026 as growth is expected to stay robust and inflation above the Fed’s target.

Musk’s Companies And Applied Intelligence

Musk has repeatedly tied economic growth to what he calls applied intelligence across his businesses.

At Tesla, he has said he is focused on developing next-generation AI chips to support autonomous driving systems. At SpaceX, the company continues to expand its satellite network and launch capacity through Starlink, aiming to meet rising global demand for data connectivity and transmission.

How Did Stocktwits Users React?

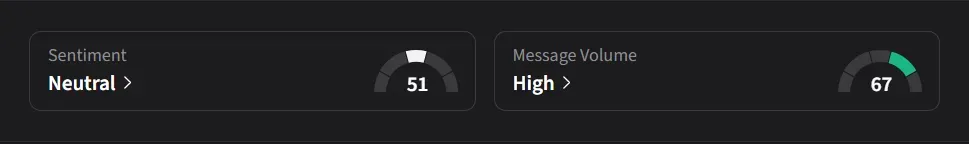

On Stocktwits, retail sentiment around Tesla was ‘neutral’ amid ‘high’ message volume, while sentiment around SpaceX was ‘bullish’ with similarly ‘high’ levels of discussion.

While SpaceX’s stock hasn’t been listed yet, Tesla’s stock has jumped 20% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<