Amid the selloff, a technical strategist said the risk vs. reward of buying stocks has become increasingly attractive.

The CBOE Volatility Index (VIX), considered a measure of volatility, has been whipsawing amid the broader market downturn triggered by President Donald Trump's "Liberation Day" tariffs.

Compiled by the CBOE Global markets, the VIX is calculated based on the options of the S&P 500 Index, using the midpoint of the option bid/ask quotes.

The index provides an instantaneous measure of how much the market thinks the S&P 500 will fluctuate in the 30 days from the time of its move.

The VIX, which traded at sub-22 levels before the April 2 tariff announcement, continued to rise over the subsequent sessions, topping at 60.13 on Monday.

That marked the index's highest level since Aug. 4, 2024, when the unwinding of yen-carry trades following the Bank of Japan's surprise rate hike triggered an across-the-board selloff in the global markets.

With Trump relenting by announcing a 90-day tariff pause for most nations, aside from the 10% baseline tariffs, volatility declined. The index nearly nearly halved and fell to a low of 31.90 on Wednesday amid the broader market rebound, only to reverse course on Thursday.

The VIX moved in a 34.44-54.87 range during the session, as the S&P 500 Index gyrated between 5,115.27 and 5,353.15, hitting the lowest point by the mid-session. Thursday's weakness followed Trump's fixation on the hefty 125% levy on imports from China and the uncertainty surrounding the whole tariff episode.

Despite trimming the losses, the broader market gauge settled down 3.46% at 5,268.05.

Things do not augur well for Friday as index futures point to a lower start by Wall Street stocks.

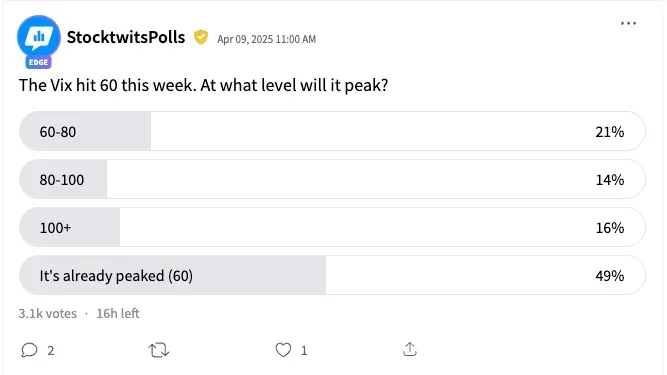

An ongoing Stocktwits poll with responses from 3,100 users suggests that nearly half of the respondents (49%) were hopeful, stating that the VIX has already peaked.

However, one-fifth of the respondents (21%) expect a move between 60 and 80 for the VIX, and 14% brace for a move to the 80-100 level. Some (14%) brace for a more aggressive swing to over $100.

A technical strategist hopes things will improve from here. In a recent note, LPL Chief Technical Strategist Adam Turnquist said that the thresholds for panic and washed-out/oversold market conditions have now largely been met.

"There is a higher probability of policy uncertainty being at/near peak levels than the probability of policy uncertainty continuing its parabolic advance," the strategist said.

"Given this backdrop, and with a confluence of support not far from current market levels, we view the risk vs. reward of buying stocks as increasingly attractive."

The SPDR S&P 500 ETF (SPY), an exchange-traded fund (ETF) that tracks the S&P 500 Index, ended Thursday at $524.58, marking a 4.38% plunge. The SPY stock is down over 10% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<