Needham cited that integrating the large, legacy studio could undermine Netflix’s agility and add a heavy burden to its operations.

- Needham pointed out that Warner’s roughly 35,000 employees, more than 2.5 times Netflix’s current workforce, would bring a dramatically different cost structure, according to TheFly.

- Needham flags generative AI as a key driver of disruption.

- Netflix is facing a consumer lawsuit seeking to block its proposed acquisition of WBD.

Netflix Inc. (NFLX) witnessed a stark warning from Needham analyst Laura Martin, who cautioned that acquiring Warner Bros. (WBD) could saddle the streaming giant with substantial risks, especially as the entertainment landscape shifts toward generative AI storytelling.

The analyst cited that integrating the large, legacy studio could undermine Netflix’s agility and add a heavy burden to its operations, according to Thefly.

Why Is Needham Alarmed?

Needham points out that Warner’s roughly 35,000 employees, more than 2.5 times Netflix’s current workforce, would bring a dramatically different cost structure and corporate environment.

That could erode Netflix’s flexibility when dealing with production unions or embracing new AI-driven content practices, it stated. Needham believes that with so much legacy overhead, the merger could reduce nimbleness and increase vulnerability to disruption.

“Without Warner, Netflix is more global, more nimble, more tech-first, and has more flexibility with the Hollywood unions,” Martin said.

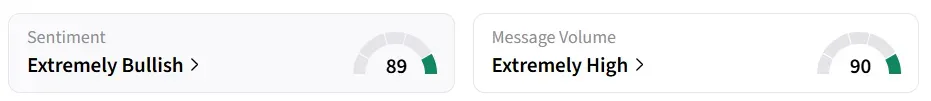

Netflix’s stock inched over 0.6% lower on Tuesday mid-morning. On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory amid ‘extremely high’ message volume levels.

Generative AI And Industry Shifts

According to a CNBC report, Needham flagged generative AI as a key driver of disruption for traditional studios. The analyst warns that combining Netflix and WBD content under a single giant company could jeopardize more than $83 billion in potential value.

“The valuation risk piece that many investors may be missing in the NFLX vs. PSKY takeover of WBD debate is how GenAI could disrupt creative storytelling over the next five years,” Martin added.

Paramount Skydance’s $108 billion offer for the entire Warner Bros. Discovery on Monday, just days after Warner Bros accepted Netflix’s $72 billion deal for its streaming and studio properties, has set up an intense merger showdown.

Also, Netflix is facing a consumer lawsuit seeking to block its proposed acquisition of WBD. The class-action suit, filed Monday, claims the deal could reduce competition in the U.S. subscription video-on-demand sector, raising antitrust concerns.

NFLX stock has gained over 7% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<