SNAP ticker climbed to the top of Stocktwits’ trending list in early Tuesday premarket trading.

- Investors are increasingly watching SNAP after its sharp slide in recent weeks.

- Stocktwits retail investors discussed Snap’s recent earnings report, buyback plan, and AR glasses.

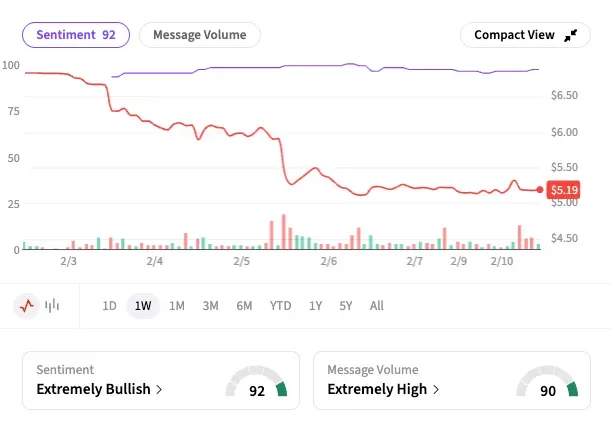

- Stocktwits sentiment for SNAP has held up in the ‘extremely bullish’ zone over the past week.

Snap Inc. shares jumped 5% in early premarket trading on Tuesday, quickly climbing to the top of Stocktwits’ most-active tickers as community buzz picked up.

Retail investors are increasingly eyeing SNAP, which has declined in eight of the last nine sessions and currently trades near a seven-year low. The Stocktwits sentiment has held up in the ‘extremely bullish’ zone over the past six days.

What’s Triggering SNAP’s Rally?

Last week, Snap reported fourth-quarter revenue that surpassed targets, although its Q1 forecast came in slightly below. In the aftermath, its shares got hammered amid a broad tech selloff.

In recent news that could have bearing on company stocks, Business Insider reported on Monday that Meta’s Instagram is testing an app that could be similar to Instagram.

The tech giant is working on an internal prototype of a new stand-alone app for sending disappearing photos, a spokesperson confirmed to Business Insider.

Meanwhile, a trial accusing the world's biggest Internet companies Meta, Google’s YouTube, Snapchat and TikTok for pushing highly addictive apps on children is beginning in a Los Angeles court this week.

Retail Traders Eye AR And Turnaround Potential

“$SNAP let's go back up to $10 then everyone will come back and HYPE FOMO MEME SNAP Inc with us,” a Stocktwits user said. “AI AR Smartglasses are the next big trillion Dollar market and SNAP is at the forefront.”

Another said: “SNAP Inc is a very innovative company from which the big once like Meta and Tik Tok are copying.”

As of the last close, Snap shares are down 36% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<