The satellite imagery provider expects fiscal 2026 revenue to be in the range of $297 million to $301 million, compared with its prior projections of $281 million to $289 million.

- Planet expects fiscal fourth quarter revenue in the range of $76 million to $80 million, while Wall Street expected $72.2 million.

- The company also reported third-quarter sales of $81.3 million, which topped estimates of $73.5 million.

- The outperformance was driven primarily by its defense, intelligence, and civil government customers, as well as by continued progress on its JSAT satellite services contract.

Planet Labs (PL) stock jumped over 20% in premarket trading on Thursday after the firm raised its forecast for annual revenue.

The satellite imagery provider expects revenue to be in the range of $297 million to $301 million for fiscal 2026, compared with its prior projections of $281 million to $289 million. Planet expects fiscal fourth quarter revenue in the range of $76 million to $80 million, while Wall Street expected $72.2 million.

Q3 Revenue Tops Estimates

The company also reported third-quarter sales of $81.3 million, which topped estimates of $73.5 million. It also posted break-even earnings on a per-share basis, while analysts expected a loss of $0.06 per share. The outperformance was driven primarily by its defense, intelligence, and civil government customers, as well as by continued progress on its JSAT satellite services contract.

Revenue from the defense and intelligence sector grew significantly year-on-year, primarily driven by contract wins with the National Geospatial-Intelligence Agency, the U.S. Navy, and international defense and intelligence customers. The commercial segment’s revenue was down in part due to seasonality in the agricultural sector and a shift in focus towards larger accounts.

The company is benefiting from increased defense spending worldwide. In October, it received a $12.8 million initial prime contractor award from the NGA under the Luno B program to carry out tasks such as vessel detections and monitoring over key areas of interest in the Asia-Pacific.

What Are Stocktwits Users Thinking?

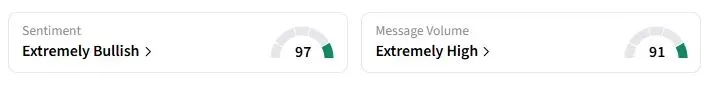

Retail sentiment on Stocktwits about Planet Labs was in the ‘extremely bullish’ territory at the time of writing.

One user noted that there’s a lot of room for the stock to rally.

Planet Labs' stock has more than tripled this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<