The Web 3.0 infrastructure provider said it now owns over 130,000 BNB tokens, valued at roughly $112 million.

- The latest accumulation is in sync with Nano Labs’ long-term plan to maintain a strategic BNB reserve.

- The company also confirmed that its Board of Directors has officially launched a previously approved share buyback initiative, capped at $25 million.

- On Wednesday, the company said that the shareholders had approved a plan to consolidate every ten shares with a par value of $0.002 into one share.

Nano Labs (NA) on Wednesday announced a fresh round of Binance Coin (BNB) acquisitions, strengthening its digital asset holdings, along with a share buyback initiative.

The Web 3.0 infrastructure provider said it now owns over 130,000 BNB tokens, valued at roughly $112 million.

RWA Infrastructure

The latest accumulation is in line with Nano Labs’ long-term plan to maintain a strategic BNB reserve. It follows the company's launch of the Next Big BNB Program (NBNB Program) in November, designed to build a comprehensive infrastructure and compliance ecosystem on the BNB Chain.

As part of the NBNB Program, Nano Labs plans to develop foundational support for tokenizing real-world assets. This includes creating custody solutions, auditing processes, rating systems, and compliance frameworks to meet regulatory standards.

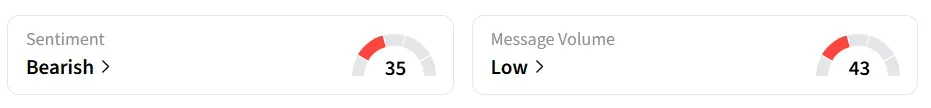

Following the update, Nano Labs’ stock traded over 11% higher in Wednesday’s premarket. On Stocktwits, retail sentiment around the stock remained in ‘bearish’ territory amid ‘low’ message volume levels.

Share Repurchase Program

The company also confirmed that its Board of Directors has officially launched a previously approved share buyback initiative, capped at $25 million. Nano Labs intends to continue repurchasing shares as market conditions allow, balancing corporate capital allocation with the growth of its BNB reserves.

Nano Labs focuses on high-performance and high-throughput computing, developing a flow processing unit (FPU) architecture that combines the strengths of both HTC and HPC chips. Additionally, the company has strategically invested in cryptocurrencies, using BNB as its primary reserve.

On Wednesday, the firm said that shareholders had approved a plan to consolidate every ten shares with a par value of $0.002 into one share valued at $0.02. Following this consolidation, 90% of undesignated shares will convert into Class A ordinary shares, while 10% will become Class B ordinary shares.

NA stock has declined by over 66% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<