The company announced that it would not appeal Nasdaq’s decision to delist its shares.

- Nasdaq determined the company was out of compliance with its $1 minimum bid price rule after shares traded below that level for 30 consecutive business days.

- Nasdaq’s volatility and stricter listing standards have created a challenging environment for small-cap firms, AREB CEO Andy Ross said.

- The company plans to initially seek a quotation on OTCID, with the long-term goal of upgrading to OTCQB or higher tiers.

Shares of American Rebel Holdings, Inc. (AREB) tanked around 60% in pre-market trading on Wednesday after the company announced that it would not appeal Nasdaq’s decision to delist its shares and instead transition to the OTC Markets.

If AREB shares maintain pre-market losses during the day, they would hit a record low.

Nasdaq determined the company was out of compliance with its $1 minimum bid price rule after its shares traded below that level for 30 consecutive business days from Dec. 17, 2025, through Jan. 30, 2026.

The company, which manufactures safes and apparel, was also ineligible for a compliance period due to multiple reverse stock splits in recent years. Trading is expected to be suspended on Feb. 13, 2026.

Why Is AREB Not Appealing?

CEO Andy Ross said that Nasdaq’s volatility and stricter listing standards have created a challenging environment for small-cap firms.

“After extensive consultation with our professional resource teams, we believe that—despite shareholder-friendly corporate actions designed to protect shareholders with minimum holdings—the volatility of the Nasdaq market and its impact on our share price, combined with increasingly stringent continued listing standards, including proposed minimum market capitalization and minimum bid price requirements, has created an untenable environment for most, if not all, small-cap companies,” said Ross.

The company plans to initially seek a quotation on OTCID, with the long-term goal of upgrading to OTCQB or higher tiers.

American Rebel said it will remain a fully reporting public company and added that shareholders will retain ownership in the company as the shares are expected to move to OTC trading after Nasdaq completes its suspension process.

How Did Stocktwits Users React?

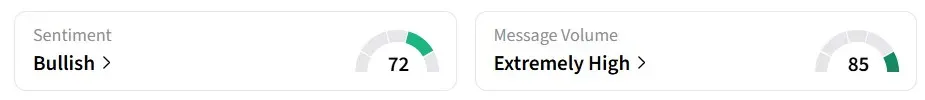

Retail sentiment on Stocktwits changed to ‘bullish’ from ‘extremely bullish’ a day earlier, amid ‘extremely high’ message volumes.

One user said the stock will drop to $0.10 next week. It is currently trading at $0.4.

Year-to-date, AREB shares have declined by more than 93%.

Read also: Silver Soars 6%, Gold Extends Gains: AG, HL, PAAS Stocks Get Pre-Market Boost

For updates and corrections, email newsroom[at]stocktwits[dot]com.<