While Stocktwits sentiment for Constellation jumped into ‘extremely bullish’ territory, it finished at a ‘bearish’ level at last close for Domino’s.

Shares of Constellation Brands surged more than 5% in after-hours trading on Friday as Warren Buffet’s Berkshire Hathaway reportedly bought a new position in the beverage company, sparking retail buzz.

Berkshire recently bought 5.6 million shares worth about $1.24 billion in the beer and wine maker, said several media reports, citing regulatory filings.

The conglomerate also reportedly increased stakes in several other companies, including Domino’s Pizza and Verisign.

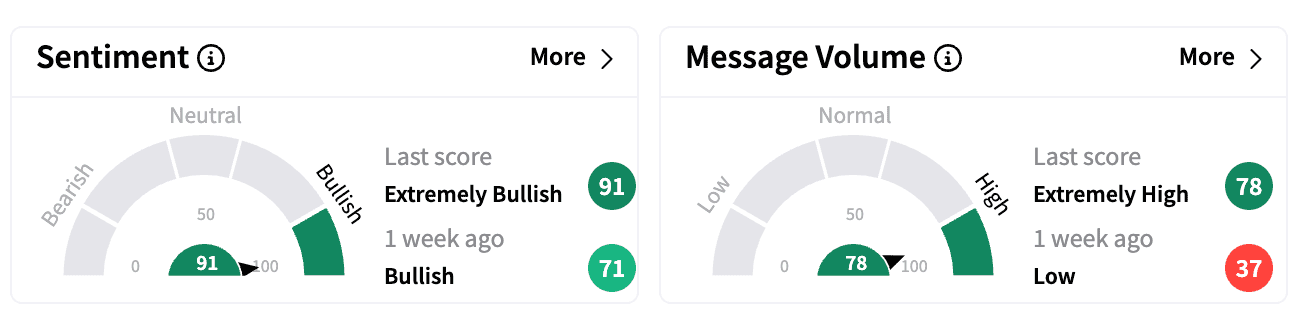

Constellation Brands’ retail sentiment on Stocktwits jumped to ‘extremely bullish’ from ‘bullish.’ Message volume jumped to ‘extremely high’ from ‘low’.

The beverage maker's stock has come under pressure of late after the U.S. Surgeon General Vivek Murthy issued an advisory linking cancer to alcohol consumption. In addition, beer sourced from Mexico such as Corona and Modelo may take a hit from Trump’s tariffs.

Berkshire Hathaway boosted its holdings in Domino’s Pizza by 1.1 million shares in the fourth quarter, worth about $450 million. The restaurant chain’s stock gained over 1% in extended trading.

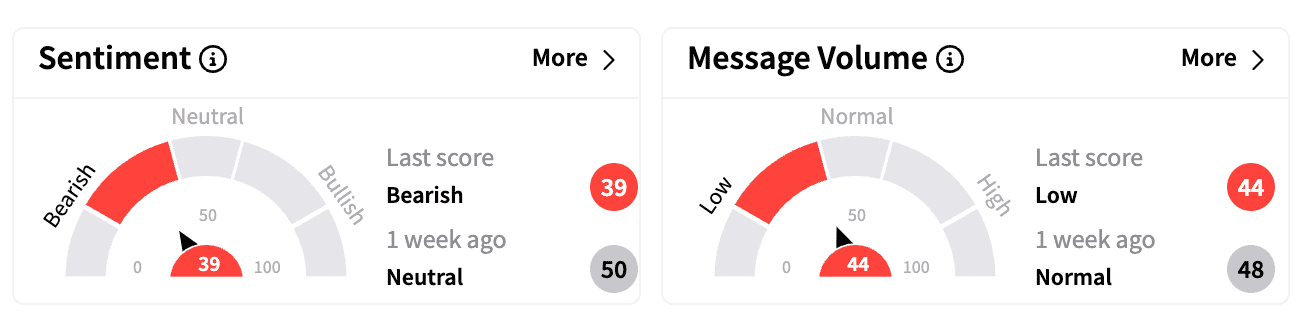

Despite Berkshire’s increased stake, sentiment on Stocktwits was far from the positive outlook of Constellation’s retail following. Compared to last week, sentiment around Domino’s stock shifted from ‘neutral’ to ‘bearish,’ with message volume dropping to the ‘low’ zone from ‘normal.’

Domino’s is expected to report earnings per share of $4.92 on revenue of

$1.48 billion for its forthcoming earnings next week.

Constellation stock is down nearly 27% year-to-date, while Domino’s has gained more than 12%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<