Retail sentiment on Stocktwits has remained ‘bullish’ on the stock.

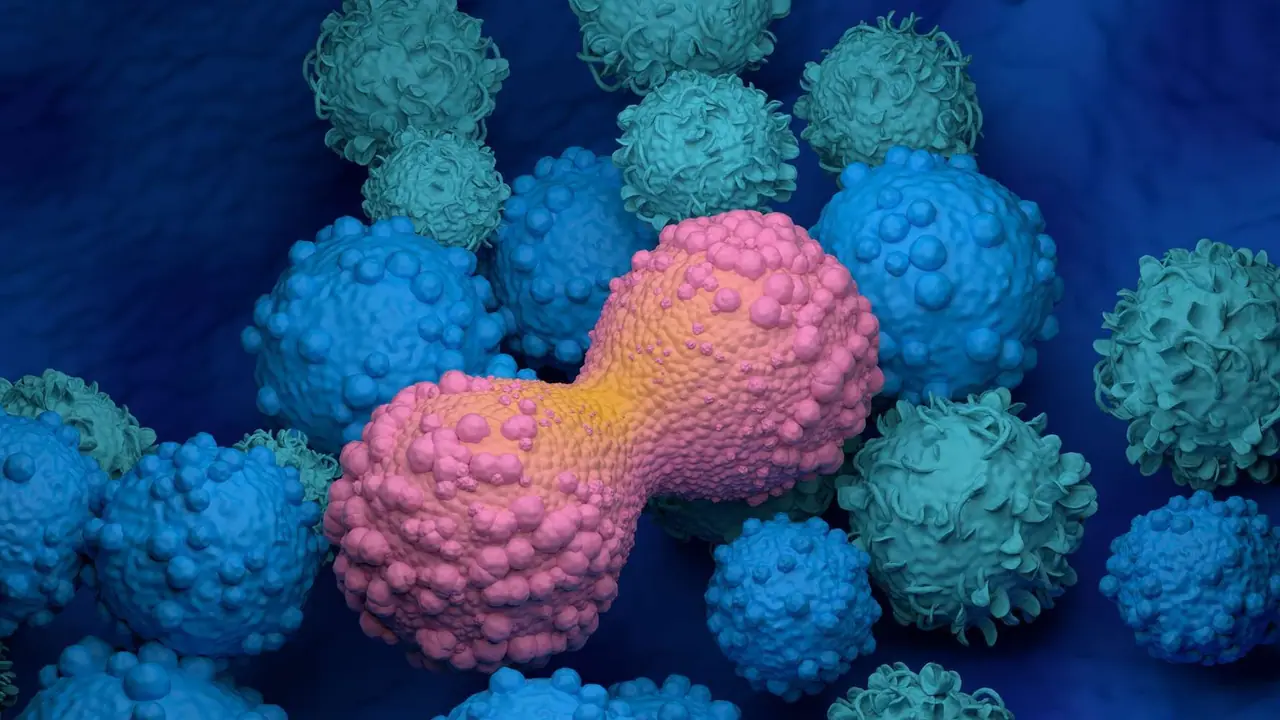

Vincerx Pharma ($VINC) shares were in the spotlight over the weekend following the company’s proposed merger with Oqory, a privately-held, clinical-stage company that develops ADCs for the treatment of multiple oncology conditions, with retail sentiment staying strong.

Vincerx stock was up 64% in after-hours trading session on Friday.

Upon completion of the proposed merger, Oqory equity holders are expected to own approximately 95% of the combined entity, while Vincerx equity holders will hold about 5%.

Vincerx plans to reduce its workforce and undertake cost-control measures, the company said. As part of this workforce reduction, its CEO Dr. Ahmed Hamdy has stepped down but will remain as chairman. Dr. Raquel Izumi has stepped down as president and COO and taken over as acting CEO in a consulting capacity; Alexander Seelenberger has stepped down as CFO.

Retail sentiment on Stocktwits has remained ‘bullish’ on the stock. Message volumes are in the ‘normal’ zone.

The merger is subject to customary closing conditions and the completion of the minimum $20 million in financing, and the continued listing of Vincerx's common stock on Nasdaq.

According to a Vincerx statement, the transaction includes a minimum fully diluted equity value of $13.66 million for existing Vincerx stockholders.

Additionally, certain Oqory-designated investors will provide interim financing to Vincerx of $1.5 million in two tranches.

The financing consists of about $1 million funded through the issuance of common stock and pre-funded warrants along with accompanying common stock warrants and approximately $500,000 funded on or prior to January 31, 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<