According to JP Morgan, Trip.com’s share price may linger in a range-bound pattern for the next four to six months as the antitrust case unfolds and new developments emerge only gradually.

- The travel booking giant’s stock declined sharply on Wednesday after Chinese regulators launched a formal antitrust investigation.

- JM Morgan said that a possible penalty from Chinese authorities could include a meaningful cash fine.

- Jefferies said penalties in prior cases generally represented a low single-digit percentage of the companies’ domestic revenue from the previous year.

JPMorgan expects continued pressure on Trip.com Group (TCOM) stock in coming sessions as investors adjust expectations to factor in potential fines and a prolonged period of regulatory scrutiny.

The travel booking giant’s stock declined sharply on Wednesday after Chinese regulators launched a formal antitrust investigation into the company for allegedly abusing its market dominance.

Analyst Rationale

According to JP Morgan, Trip.com’s share price may linger in a range-bound pattern for the next four to six months as the antitrust case unfolds and new developments emerge only gradually, according to TheFly.

While JPMorgan maintained an ‘Overweight’ rating on Trip.com’s stock, the firm cautioned that a possible penalty from Chinese authorities could include a meaningful cash fine.

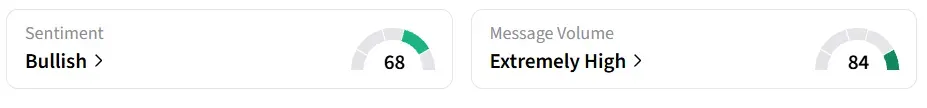

At the time of writing, TCOM stock traded over 16% lower on Wednesday mid-morning. On Stocktwits, retail sentiment around the stock changed to ‘bullish’ from ‘neutral’ territory the previous day. Message volume shifted to ‘extremely high’ from ‘high’ levels in 24 hours.

Antitrust Inquiry

Trip.com said on Wednesday that China’s State Administration for Market Regulation (SAMR) has begun a probe into it under the nation’s Anti-Monopoly Law, focusing on the company’s business conduct.

According to a Reuters report, the SAMR’s case was initiated after preliminary checks into whether Trip.com may have leveraged its market position in ways that might suppress fair competition.

According to Jefferies, prior antitrust investigations involving companies such as Alibaba and ArcelorMittal typically lasted several months before regulators issued a final decision. Penalties in those cases generally represented a low single-digit percentage of the companies’ domestic revenue from the previous year, the firm noted.

TCOM stock has declined over 1% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<