Quantum computing stocks remain volatile and speculative, but rising institutional validation and sustained retail optimism suggest the sector’s rally still has legs.

- Quantum stocks have resumed their rally on renewed institutional validation and retail optimism, even as price swings remain pronounced.

- With scalability and commercialization timelines still uncertain, gains are likely to favor companies that demonstrate more precise execution and stronger strategic partnerships.

- A majority of retail traders are bullish despite the volatility and mixed fundamentals.

Quantum computing stocks are surging sharply again, even in the absence of any major industry-shaking news. The renewed enthusiasm seems to be driven less by hard catalysts and more by anticipation, with investors looking ahead to the Consumer Electronics Show 2026, set to kick off on Jan. 6.

Adding a spark to the optimism, D-Wave Computing said its quantum technology evangelist, Murray Thom, will take the CES stage to showcase a live demo of the company’s award-winning systems, alongside real-world customer success stories, a signal that quantum's promise is inching closer to practical application.

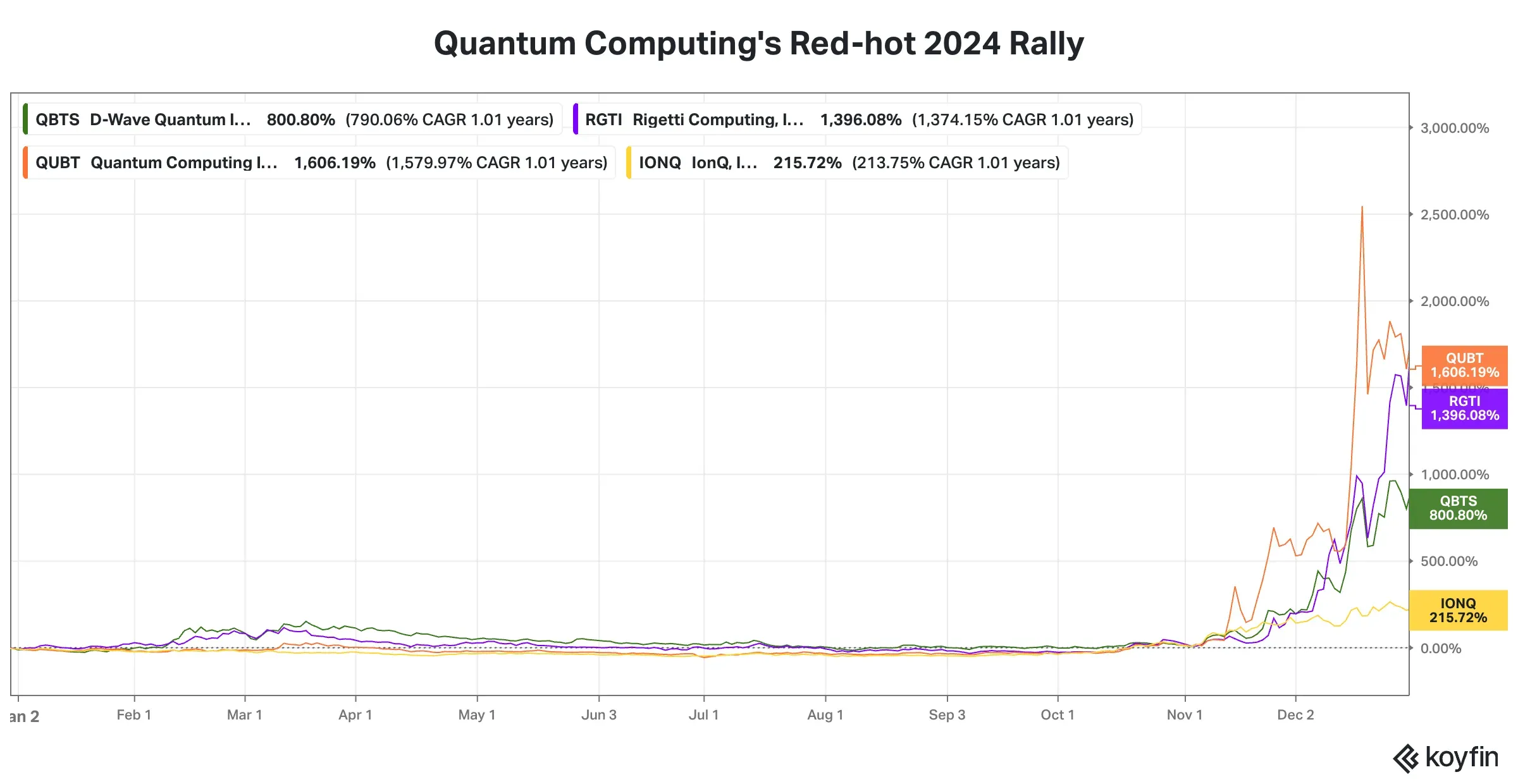

Skepticism around the technology’s near-term commercial impact still lingers, but that hasn’t stopped investors from piling into the sector. Most smaller publicly traded quantum companies are now on track for a second straight year of gains. The rally in 2024 was nothing short of spectacular, led by D-Wave, whose shares skyrocketed by more than 1,600%, with much of that surge packed into the final two months of the year.

Source: Koyfin<

Source: Koyfin<

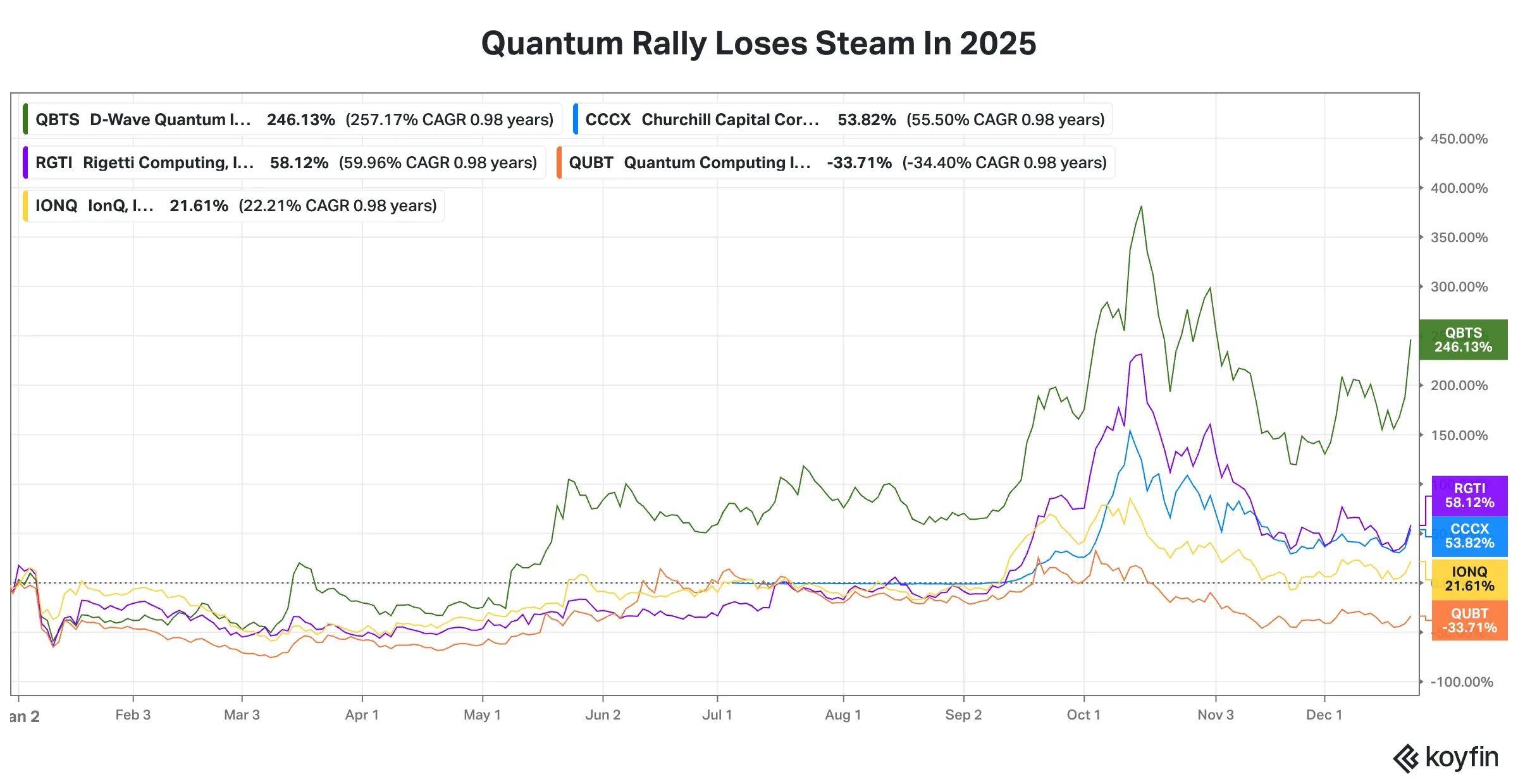

The rally stalled at the start of the year, with most, barring D-Wave, trading in the red until mid-to-early September. Thanks to a recovery, catalyzed by Wall Street’s acknowledgment of the technology’s relevance, and some company-specific updates, the quantum rally reignited. The move since then, however, has been interspersed by pullbacks and recoveries, and the gains haven’t been across the board.

Source: Koyfin<

Source: Koyfin<

Retail Upbeat Rally Will Continue

Despite the volatility in quantum stocks, retail traders largely brace for more gains. An ongoing Stocktwits poll that asked retail users of the platform, “How Will Quantum Computing Stocks Perform in 2026?” found that a majority (51%) expect “strong gains across the sector.” But the view isn’t unanimous. Among the respondents, 13% called for a “sharp decline & reset,” while 7% foresaw flattish performance.

A sizeable proportion (29%) of respondents bracing for “selecting, winners, mixed results.” If that is the case, investors are left to contend with the question of which ones will outperform and which will lag.

Drawing Strategic Spotlight

Before assessing specific stocks, here’s Wall Street’s crystal-ball view of the industry.

The strongest validation from Wall Street firms came in the form of a key development. JPMorgan included quantum computing in the list of industries critical to the national economy. In a statement released in mid-October, the firm said it will make direct equity and venture capital investments of up to $10 billion to help select companies primarily in the United States enhance their growth, spur innovation, and accelerate strategic manufacturing.”

Separately, Morgan Stanley disclosed a 7% stake in IonQ in August.

The Trump administration also took cognizance of the industry's prospects and its critical nature. A Wall Street Journal report, citing sources, stated in late October that the government is mulling small investments in quantum computing names, although no confirmation has come yet.

Privately held Quantinium, formed in 2021 through the merger of Cambridge Quantum Computing and Honeywell Quantum Solutions, was in the news following the unveiling of its Helios quantum computer. The company has also forged partnerships to foray into the Middle East, especially Qatar and the UAE.

McKinsey estimates that quantum computing, quantum communication, and quantum sensing — the three pillars of the technology — would together generate up to $97 billion in worldwide revenue by 2035, a quantum leap from $4 billion in 2024.

Matt Kinsella, CEO of Infleqtion, another privately held quantum computing name, which has agreed to merge with Churchill Capital Corp X (CCCX), a SPAC, outlined these multiple opportunities in an interview with Stocktwits in November. Infleqtion specializes in quantum sensors used in quantum clocks, RF antennas, gravimeters, and other inertial sensing equipment.

The Pushbacks

The technology itself faces hurdles—including qubit instability, the need for fault-tolerant architectures, limited coherence times, and complex error-correction requirements—that continue to constrain scalability, practical applications, and reliability.

Kinsella said the wait for commercially viable computers may not be far off. The executive said it might take until 2028 for Infleqtion to go to 100 logical qubits, which are error-corrected physical qubits. This is when quantum computers will begin to do what classical computers can’t do, he added.

Which is most profitable to buy?

According to Koyfin, the upside potential relative to the average analyst price targets for the publicly listed names is as follows:

| Upside Potential | Analyst Coverage | Proportion of bullish analysts | Retail Sentiment* | |

| D-Wave | +21% | 14 | 93% | Bullish |

| IONQ | +39% | 12 | 75% | Bullish |

| Rigetti | +42% | 11 | 73% | Extremely bullish |

| Quantum Computing | +38% | 4 | 50% | Neutral |

*based on the Stocktwits sentiment meter

While broad-based gains may prove elusive, select names with clearer commercialization pathways and strategic backing are likely to drive performance into 2026. It should be noted that these companies are up against big techs, some of which have amped up their bets on quantum computing. IBM, considered a pioneer, is still in the fray, while Microsoft and Alphabet have unveiled in-house quantum chips, and Google has launched an algorithm called “Quantum Echoes.”

Infleqtion’s Kinsella also raised the possibility of an industry shakeout in the Stocktwits interview. “I think you'll probably end up with a handful of very large, very important quantum companies over the course of the next five to 10 years,” he said.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<