Robotaxi momentum is lifting Tesla stock, as Waymo still leads, China accelerates competition, and analysts see autonomous rides as a significant long-term driver of valuation for growth.

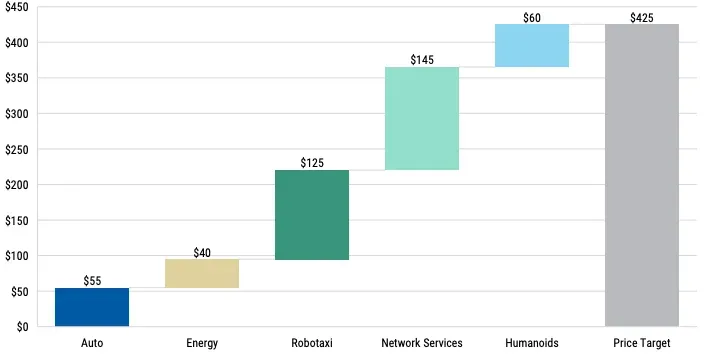

- Robotaxis are becoming central to Tesla’s valuation, with Morgan Stanley estimating roughly 30% of the stock’s sum-of-the-parts value is tied to autonomous ride-hailing.

- Cost advantage strengthens the long-term thesis, as Tesla’s estimated $0.59-per-mile operating cost undercuts Waymo and traditional ride-hailing peers.

- Execution risk remains high despite progress, with competition intensifying globally and Tesla still needing to prove it can scale.

Tesla stock has received a boost in recent sessions from the chatter about Robotaxi progress, even as the Elon Musk-led company’s electric-vehicle (EV) business sputters. The company has given its loyal investor base one more reason to stay optimistic about a wider rollout of the service by updating the webpage, meant exclusively for robotaxis.

“We’re bringing autonomous rides to you today—starting with Model Y. Autonomous Robotaxi rides are currently being offered in Austin, Texas. To get started, download the Robotaxi app,” the refreshed page read.

“Cybercab, our purpose-built fully autonomous vehicle, will offer rides in your area in the future.”

The company also shared a video highlighting the service's accessibility. “Our Robotaxi vehicles are designed to support various accessibility needs, including space for service animals and room to store some wheelchairs and other assistive devices.”

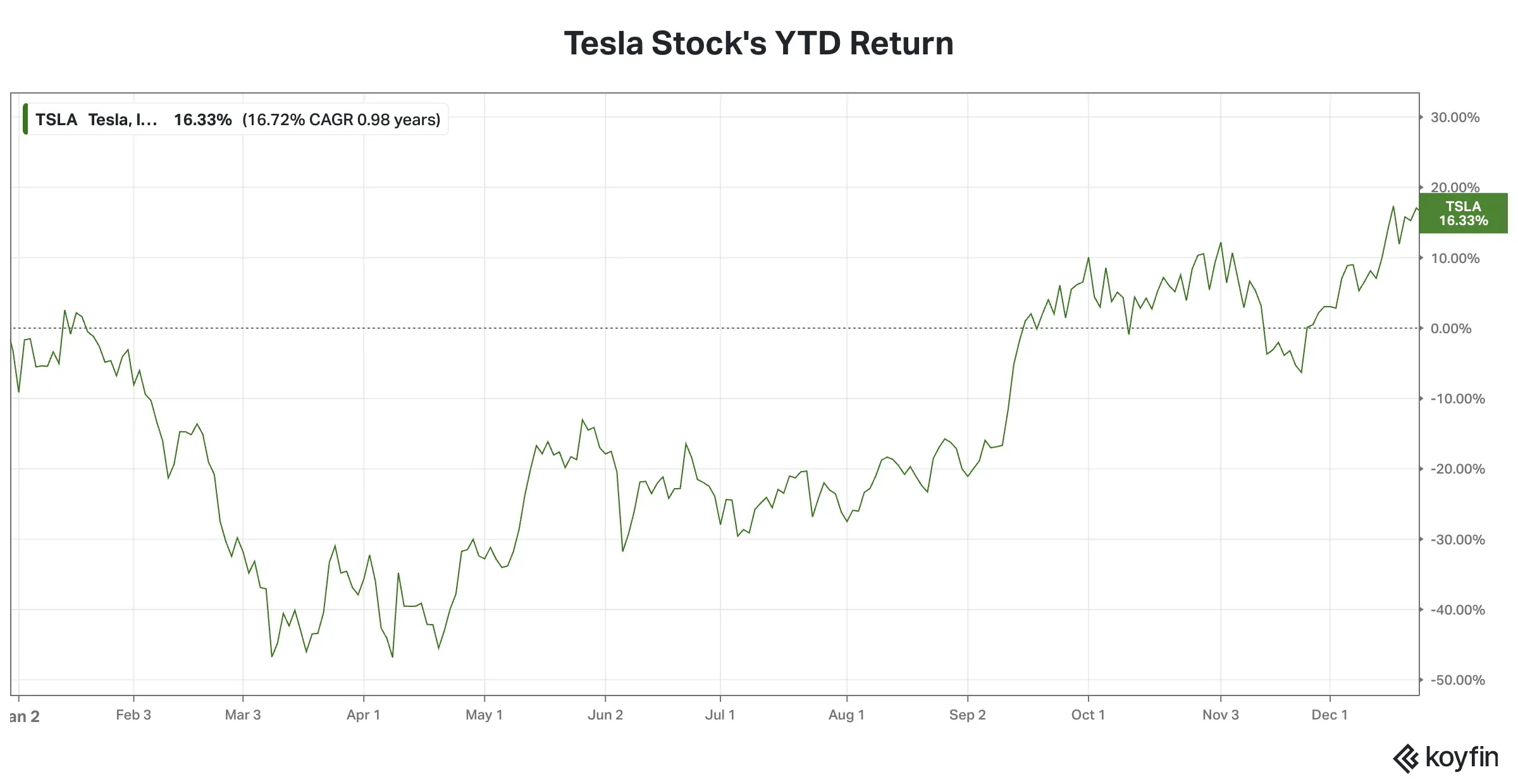

Tesla stock has returned more than 16% this year, thanks to the late-year momentum it picked up.

Source: Koyfin<

Source: Koyfin<

Does this mean Tesla is finally hitting all the right notes with respect to a service that Cathie Wood’s Ark Invest touts as a $10 trillion opportunity globally?

Waymo Leads As US Robotaxi Race Accelerates

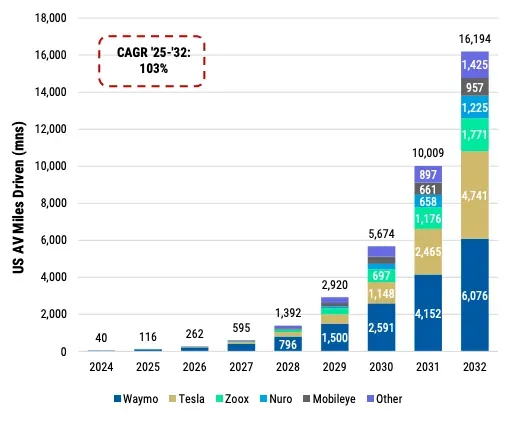

The U.S. robotaxi market is currently dominated by Alphabet’s Waymo, Amazon-owned Zoox, and Tesla. Waymo’s fleet numbered 2,500 vehicles in November, according to S&P Global. Its services are available in Atlanta and Austin, in partnership with Uber, in Phoenix and San Francisco. Public services are launching shortly in a slew of other U.S. cities, such as Dallas, Denver, Detroit, Houston, Las Vegas, and Washington, as well as in London. The company is also planning and testing services in more cities, including Tokyo, Japan, and also operates fully autonomous vehicles in Miami without safety operators.

Amazon’s Zoox received an exemption from the National Highway Traffic Safety Administration (NHTSA) in August to test its custom robotaxis on public roads. Zoox’s services are now active in eight cities, including Atlanta, Austin, Las Vegas, Miami, the San Francisco Bay Area and Seattle.

Tesla launched its robotaxi service in Austin in late June. Although the size of the robotaxi fleet operated in Austin isn’t known, Musk said in a post on X in late November that “The Tesla Robotaxi fleet in Austin should roughly double next month.” Recently, a video shared by Tesla AI senior software engineer Phil Duan showed a Model Y running the full self-driving (FSD) service without a safety driver in Austin, which made a splash on social media.

The company is also rapidly scaling up robotaxi operations in California. It has registered 1,665 vehicles for its Bay Area ride-hailing service in the California Public Utilities Commission (CPUC), and 798 drivers, the Business Insider reported, citing a CPUC spokesperson.

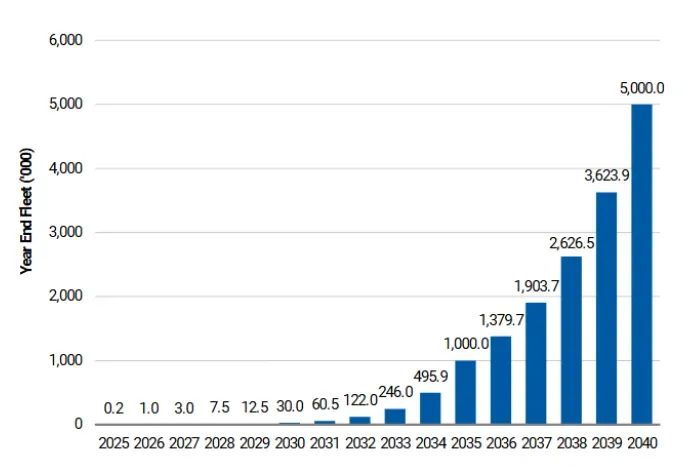

According to Morgan Stanley’s estimates, Tesla is likely operating 200 robotaxis in the U.S., and the number is expected to grow exponentially to 1,000 by 2026, reaching up to 5 million by 2040.

Tesla Robotaxi Fleet

Source: Morgan Stanley<

US Autonomous Vehicle Miles Driven (By Companies)

Source: Morgan Stanley<

As part of his tech predictions for 2026, Tesla bull and Wedbush analyst Daniel Ives expects Tesla to launch Robotaxis in over 30 cities successfully and begin scaling volume production of Cybercabs.

Tesla’s Best — Musk

Tesla’s CEO still considers the company’s AI software the “best-of-breed”. Musk countered a statement from Tesla’s erstwhile AI Director, Andrej Karpathy, who said both Waymo’s and Tesla’s appear to offer the “perfect drive.” Calling Andrej’s understanding “dated,” Musk said:

“Tesla AI software has advanced vastly beyond what it was when he left. The intelligence density per GB of Tesla AI is at least an order of magnitude better than anything else out there.”

Competition Heats Up In China

Outside of the U.S., China is seeing cut-throat competition as more and more robotaxi operators make rapid strikes. S&P Global states that supportive legislation, the establishment of pilot zones, and the issuance of autonomous vehicle testing licenses have paved the way for more rapid growth in mainland China than in the U.S.

Baidu’s Apoll Go, the biggest service, operates more than 1,000 self-driving cars, an Economist report said. The company hopes to deploy 20,000 robotaxis worldwide by 2027. Pony.ai’s services are available in four cities, and WeRide operates in three cities, while legacy automaker Geely’s CaoCao Moniloty has started trial runs in two cities.

WeRide, founded in 2017 by former Baidu Autonomous Driving Unit chief scientist Tony Han, operates more than 1,600 vehicles, including robotaxis, robobuses, robotrucks, and robosweepers, according to a Morgan Stanley report.

A Goldman Sachs report published in May stated that China’s total Robotaxi fleet is expected to grow from 4,100 in 2025 to 0.5 million in 2030 and 1.9 million in 2035. From a revenue perspective, the market will grow from a little over $50 million in 2025 to $50 billion by 2035.

What Robotaxi Means For Tesla Stock

Morgan Stanley’s valuation framework for Tesla suggests about 30% is attributable to robotaxis.

Tesla: Sum-of-the-parts Valuation

Source: Morgan Stanley<

As the competition heats up, Morgan Stanley believes Tesla has a significant cost advantage in the U.S., at $0.59/mile compared to its biggest competitor, Waymo, at $0.99/mile, and existing rideshare operators at $1.71/mile. This, according to the firm, is due in part to its vertical integration of vehicle production and camera-only sensor suite.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<