The electric vehicle maker’s retail sales in January stood at 18,485 vehicles, its lowest monthly figure since November 2022.

- Exports from its Shanghai plant were 50,644 vehicles in January, a 71% jump from a year earlier.

- Including domestic sales and exports, wholesale volumes increased 9.3%.

- Model Y wholesale sales came in at 38,916 units while Model 3 volumes totalled 30,213 units.

Tesla’s (TSLA) China deliveries reportedly declined sharply in January, even as exports from its Shanghai factory saw a 71% increase.

The electric vehicle (EV) maker’s retail sales in January stood at 18,485 vehicles, its lowest monthly figure since November 2022, according to a report by the CNEVPost on Thursday, citing data from the China Passenger Car Association (CPCA).

Retail sales dropped 45% from January 2025 and plunged more than 80% from December 2025. Tesla’s Shanghai facility produces the Model 3 sedan and Model Y, serving both domestic and overseas markets.

TSLA shares were up 0.7% in pre-market trading.

Exports Drive Wholesale Growth

While local deliveries weakened, Tesla increased shipments abroad. The Shanghai plant exported 50,644 vehicles in January, a 71% jump from a year earlier. Including domestic sales and exports, wholesale volume reached 69,129 units, up 9.3% year-on-year but nearly 29% lower than December.

Model Y wholesale sales rose about 21% from last year to 38,916 units, though they fell sharply from the prior month. Model 3 volumes totalled 30,213 units, edging slightly lower both annually and sequentially.

Challenging Market Conditions

January is typically a slow month for China’s auto market, but broader industry trends also weighed on demand. Total new energy vehicle (NEV) retail sales fell 20% to 596,000 units, while battery electric vehicle (BEV) sales declined 17%. Tesla holds around 3.1% of the NEV market and 5.3% of the BEV segment, according to the report.

Policy changes, including a new 5% purchase tax and reduced trade-in subsidies, have further cooled consumer interest.

Tesla is also facing pressure outside China. January registrations dropped 42% in France and 88% in Norway, a historically strong market for Tesla. U.S. sales fell 17%, marking a fourth consecutive monthly decline.

How Did Stocktwits Users React?

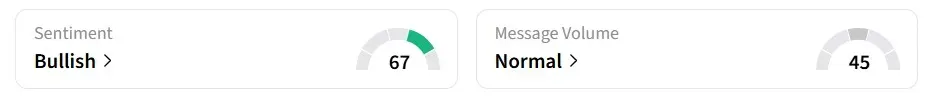

Retail sentiment remained in the ‘bullish’ territory over the past 24 hours.

However, retail commentary was mixed. One user expects the stock to climb to $440. It is currently trading at $428.

Another user expects the stock to fall to $300 if it breaks below its $390 support.

TSLA shares have shed around 6% so far in 2026.

Read also: ICLR Stock Crashed 33% In Pre-Market Today - Why Did The Company Withdraw Its FY2025 Guidance?

For updates and corrections, email newsroom[at]stocktwits[dot]com.<