The company’s enhanced version of Direct Liquid Cooling (DLC-2) technology is expected to slash electricity use by 40% and the cost of ownership by up to 20%.

Super Micro Computer Inc. (SMCI) shares traded 12.8% higher on Wednesday after the company introduced an enhanced version of its Direct Liquid Cooling (DLC-2) technology.

The technology features new capabilities to cut energy consumption, lower operational expenses, and speed up deployment timelines in AI-optimized data centers. It is tailored to support the rising need for energy-efficient infrastructure as AI usage accelerates.

Super Micro’s updated DLC solution enables data centers to reduce electricity consumption by as much as 40%, while achieving a similar reduction in water usage by utilizing higher inlet temperatures of up to 45°C.

This advancement removes reliance on traditional chiller systems and can decrease total cost of ownership by up to 20%.

The DLC-2 system features a high-density server with advanced cooling, using cold plates across major components to cut noise and eliminate the need for large fans, maintaining quiet operation at about 50 decibels.

DLC-2 also boosts cooling efficiency and computing density through vertical coolant distribution and up to 98% rack coverage.

Integrated management software and hybrid cooling towers help reduce environmental impact and operating costs while supporting scalable, high-performance data center deployments.

Super Micro operates manufacturing sites in San Jose, Europe, and Asia, providing production capabilities for its liquid-cooled rack solutions.

Super Micro shares have been on the rise since the beginning of this week after the U.S. and China reached a temporary trade agreement, significantly reducing tariffs on each other’s goods.

The stock received a further boost after President Donald Trump's visit to Riyadh resulted in a $600 billion investment agreement. Saudi data company, DataVolt, inked a multi-year partnership with Super Micro worth $20 billion.

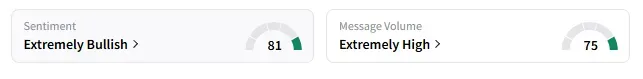

On Stocktwits, retail sentiment surrounding Super Micro shares turned ‘extremely bullish’ from ‘bullish’ the previous day.

A Stocktwits user vouched for the company’s bright future with the $20 billion Saudi deal.

Super Micro Computer stock has gained 43.7% in 2025 and lost 46.7% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<