Springview jumped 15% in Friday’s premarket session and was among the top trending tickers on Stocktwits.

- Springview announced a memorandum of understanding to install rooftop solar and energy-efficiency solutions in residential projects in Singapore.

- Stock jumped by 674% on Thursday, following the news.

- Springview completed a 1-for-8 reverse split last month and has a low float.

Shares of Springview Holdings, a Singapore-based micro-cap company, continued their ascent on Friday, rising 15% in the premarket session.

The shares drew high-octane chatter on Stocktwits – rising to nearly the top of trending tickers on the platform at the time of writing this report – following a 674% rally on Thursday.

A key partnership announcement woke up the sleepy stock. The residential builder unveiled a memorandum of understanding with China-based Jiangsu GSO New Energy Technology to integrate rooftop solar and energy-efficiency solutions into residential projects in Singapore.

Under the plan, GSO will offer product solutions, engineering support, and technical expertise, while Springview will ensure project delivery, regulatory coordination, and homeowner engagement within Singapore. To be sure, it is not a binding deal, and Springview did not share revenue or expectations.

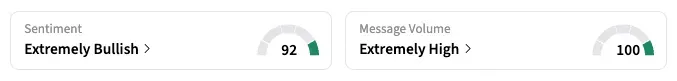

On Stocktwits, the retail sentiment shifted to ‘extremely bullish’ from ‘bearish’ the previous day, with ‘extremely high’ message volume.

Earlier this month, Springview announced a deal with Future Faith Pte. Ltd. to sell premium hardwood and sawn timber, with Springview serving as the distributor in the Singapore market.

The company carried out a steep 1-for-8 reverse split on December 2, 2025, slashing its share count from 13.2 million to 1.65 million to meet Nasdaq rules. With thin daily volume, there is limited scope for institutional liquidity buying, leaving it prone to sharp swings driven by retail traders.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<