SMX’s platform embeds encrypted identifiers into a wide range of materials, allowing products to be linked to permanent digital records that verify their origin and lifecycle.

Digital technology firm SMX’s (Security Matters) (SMX) over 100% surge on Friday has sparked excitement among retail traders as the company views the GENIUS Act as a game changer in how U.S. businesses track, follow rules, and prove their sustainability efforts.

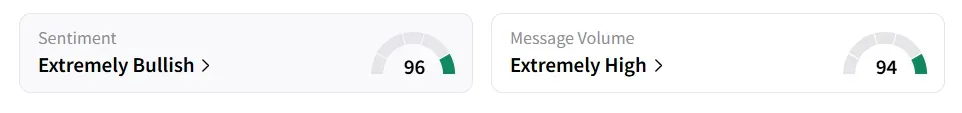

On Stocktwits, retail sentiment around SMX remained in ‘extremely bullish’ (96/100) territory amid ‘extremely high’ (94/100) message volume levels.

Both retail sentiment and message volume were the highest year-to-date. User message count surged 226% in the last 24 hours.

A Stocktwits user highlighted why they went long on the stock.

Another user said the company is doing some ‘interesting stuff’.

SMX stated that the GENIUS Act marks a new era of traceability, compliance, and verified sustainability in the U.S. economy.

Passed last week in Washington, the legislation establishes a comprehensive legal framework for integrating secure, data-driven systems across various industries.

It has also laid the groundwork for compliant blockchain-based transactions across consumer and enterprise markets.

The GENIUS Act aims to transform how businesses authenticate their processes and materials throughout the entire supply chain.

SMX, a developer of a patented molecular tracking technology, appears uniquely positioned to benefit from this policy shift.

The company’s platform embeds encrypted identifiers into a wide range of materials, including plastics, metals, and liquids, enabling products to be linked to permanent digital records that verify their origin and lifecycle.

What started as a tool for industrial traceability has become a broader solution for regulators, manufacturers, and consumers seeking verifiable compliance, according to the company.

On July 22, SMX unveiled a strategic move by launching a wholly owned subsidiary in Ireland, named SMX (Treasury and Asset Holding Company) to support its development of forward-looking financial instruments.

SMX stock has lost over 96% of its value year-to-date and more than 99% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<