KeyBank downgraded ServiceNow to ‘Underweight’ from ‘Sector Weight’ with a price target of $775.

- The analyst expects the "death of software-as-a-service" will weigh down ServiceNow in 2026, according to TheFly.

- Earlier, Bloomberg reported that ServiceNow is allegedly mulling the acquisition of a cybersecurity startup for $7 billion.

- ServiceNow had posted market-beating results for its third quarter in October and also approved a five-for-one stock split.

ServiceNow Inc. (NOW) shares traded over 5% lower in Monday’s pre-market after KeyBanc downgraded the stock.

Analyst Jackson Ader at KeyBlanc downgraded NOW to ‘Underweight’ from ‘Sector Weight’ with a price target of $775, according to TheFly. The back-office employment data suggest that the "death of software-as-a-service" narrative could start to weigh on ServiceNow in 2026, the analyst stated in a research note.

Acquisition Talks

The downgrade comes on the back of a Bloomberg report stating that ServiceNow is looking to acquire Armis, a cybersecurity startup, in a $7 billion deal, which could be announced in the coming days.

Earlier this month, the software-as-a-service (SaaS) company announced plans to acquire Veza, an identity security company, to augment its AI- and data-focused goals. “In the era of agentic AI, every identity — human, AI agent, or machine — is a force for enterprise impact. It’s only when you have continuous visibility into each identity’s permissions that you can trust it,” Amit Zavery, president, chief operating officer, and chief product officer at ServiceNow, said at the time.

The Armis acquisition would further augment ServiceNow’s security capabilities. California-based Armis specializes in agentless cybersecurity that helps identify and track security threats on devices across industries.

ServiceNow posted market-beating results for its third quarter in October and also approved a five-for-one stock split. Earlier this month, Dan Ives, managing director at Wedbush Securities, also announced that ServiceNow Inc. (NOW) had been removed from the IVES AI 30 winner list.

How Did Stocktwits Users React?

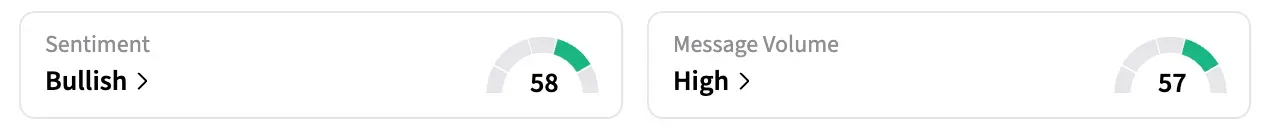

On Stocktwits, ServiceNow was trending in the seventh position on Monday morning. The retail sentiment around NOW jumped to ‘bullish’ from ‘neutral’ territory a day ago, while message volume increased to ‘high’ from ‘normal’ levels at the time of writing.

Shares of NOW are down over 23% over the last year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<