Ripple’s bullish momentum comes after Franklin Templeton’s filing for a spot XRP ETF on Tuesday.

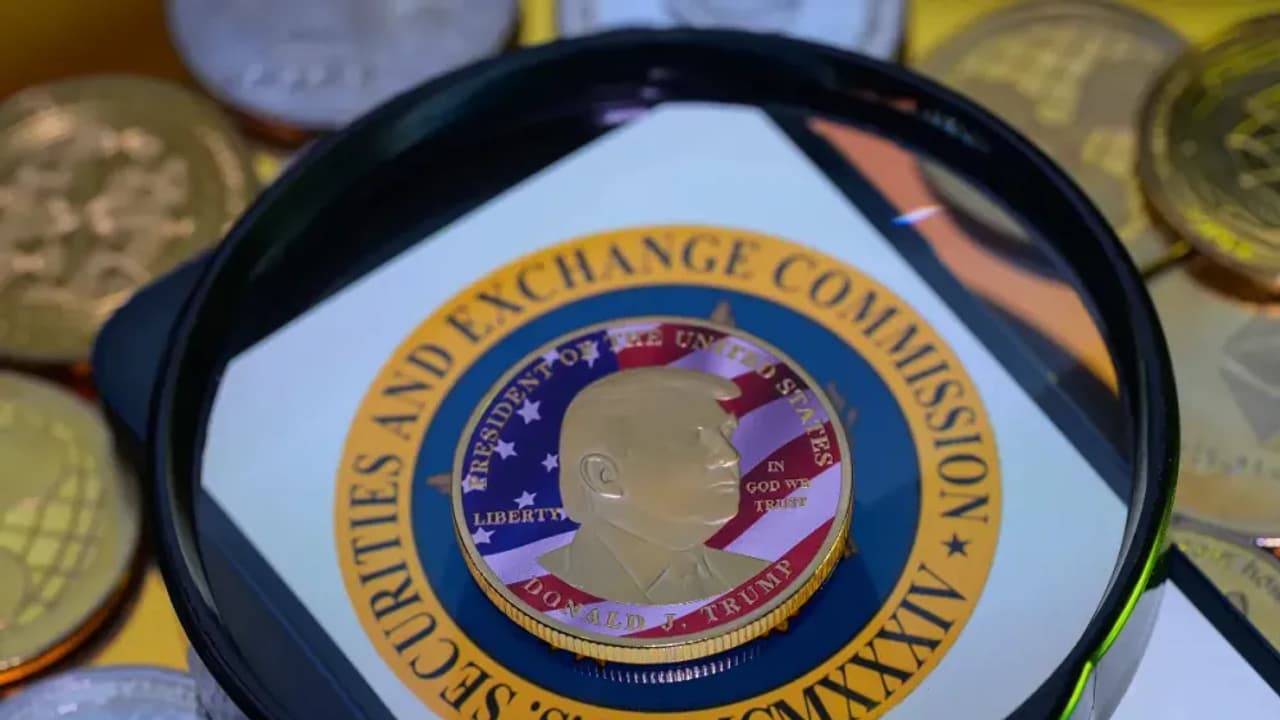

The U.S. Securities and Exchange Commission has postponed its decision on several exchange-traded funds tied to Ripple’s XRP (XRP), Solana (SOL), Litecoin (LTC), and Dogecoin (DOGE), delaying clarity for investors awaiting regulatory approval.

Solana traded flat, while Dogecoin and XRP rose by at least 2.5% for the day during U.S. pre-market hours on Wednesday, according to CoinGecko data.

Even Litecoin gained 1% as Bitcoin’s price rebounded above $82,000, recovering from a dip below $78,000 late Sunday.

Despite the uptick in prices, retail sentiment across major tokens remained largely unchanged.

In a series of filings on March 11, the SEC stated it had “designated a longer period” to evaluate proposed rule changes required for these ETFs. At least 12 applications are now in limbo.

Among the affected funds are Grayscale’s XRP Trust and Cboe BZX Exchange’s spot Solana ETF, both of which will face a delayed decision until May.

This marks another instance of the SEC pushing back ETF approvals. On Feb. 28, it extended its review of a Cboe Exchange request to list options tied to Ether ETFs.

The delays come as a wave of altcoin ETF applications followed President Donald Trump’s election and the resignation of former SEC Chair Gary Gensler.

Trump’s appointment of former SEC Commissioner Paul Atkins, a known crypto advocate, as the agency chair in early December had initially fueled optimism. However, Congressional confirmation hearings for Atkins have yet to be scheduled.

Retail sentiment on Stocktwits showed mixed reactions. Sentiment around Dogecoin’s token remained ‘bearish’ and saw the sharpest decline among the four tokens.

Over the past year, Dogecoin has lost 1.8% and trades 65% below its 52-week high of $0.4835.

Retail sentiment on Stocktwits around Litecoin’s token dipped lower within ‘extremely bearish’ territory, with reduced chatter signaling waning retail interest.

One Stocktwits user lamented the market’s shift from decentralization to ETF speculation.

Another user took an optimistic stance, predicting more ETF filings and a wave of approvals once the delays are resolved.

Litecoin has fallen 7.5% over the past year and is down 38% from its 52-week high of $146.

Retail sentiment around Solana’s token also remained in ‘bearish’ territory but showed slight improvement.

One trader noted they would accumulate more Solana if it dropped to $119, implying a potential 4.8% downside from current levels.

Solana is down 17.2% over the past year and trades 57% below its all-time high of $293, seen in January.

XRP was the exception, maintaining ‘bullish’ sentiment on Stocktwits alongside heightened retail chatter.

The improvement follows Franklin Templeton’s filing for a spot XRP ETF on Tuesday.

The proposed fund, set to trade on the Cboe BZX Exchange, would track XRP’s spot price with assets custodied by Coinbase. The fund will not distribute forks or airdrops from the XRP Ledger.

However, some traders were skeptical about the sustainability of recent gains, with one predicting a pullback following the release of inflation data later today.

XRP’s value has more than quadrupled over the past year but remains 52% below its 52-week high of $3.39.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

Read also: Bitwise Launches ETF Of Companies With Bitcoin In Their Coffers – Strategy Shares Surge As Stock Tops Holdings