Benchmark expects Q4 revenue of $1.27 billion with a narrower loss than consensus.

- Benchmark reiterated a ‘Buy’ rating with an $18 price target, implying a 22% upside.

- Attention is also on Rivian’s upcoming R2 SUV, with the company set to share pricing and configuration details on March 12.

- Benchmark highlighted solid liquidity and the potential for "modest full-year gross profit."

Shares of Rivian Automotive, Inc. shares rose nearly 1% in premarket trading on Thursday as investors positioned ahead of the EV maker’s fourth-quarter (Q4) earnings due later in the day and awaited fresh details on its upcoming R2 SUV.

Benchmark View Ahead of Q4 Results

Benchmark reiterated a ‘Buy’ rating on Rivian on Wednesday and maintained an $18 price target, which implies an upside of about 22% from the stock’s last close, according to a report by EV.

The brokerage expects Q4 revenue of $1.27 billion, broadly in line with the FactSet consensus of $1.26 billion. The estimate reflects a 27% year-over-year decline, with deliveries seen at 9,745 vehicles.

Benchmark forecasts a Q4 loss of $0.61 per share, compared with the consensus estimate of a $0.71 loss. The brokerage said liquidity “remains solid,” citing $7 billion in cash and more than $10 billion in incremental capital, and pointed to expectations for a “modest full-year gross profit,” alongside adjusted losses of $1.7-1.9 billion and capital expenditures of $1.6-1.7 billion.

Meanwhile, Koyfin estimates Q4 revenue of $1.27 billion versus $1.56 billion in the prior quarter, with GAAP loss per share estimated at $0.80 and adjusted loss per share of $0.67.

R2 SUV Update in Focus

Earlier this week, Rivian said it will share more details on its R2 SUV on March 12, including pricing and available options. The first R2 variant, featuring dual motors and all-wheel drive, is expected to launch this spring.

The midsize SUV is projected to be priced around $45,000, positioning it against Tesla’s Model Y. Production is planned initially in Illinois, with additional capacity from the Georgia plant once operational.

Rivian’s current R1T pickup and R1S SUV are both priced above $70,000. The R2 is intended to move the company into the mass-market EV segment.

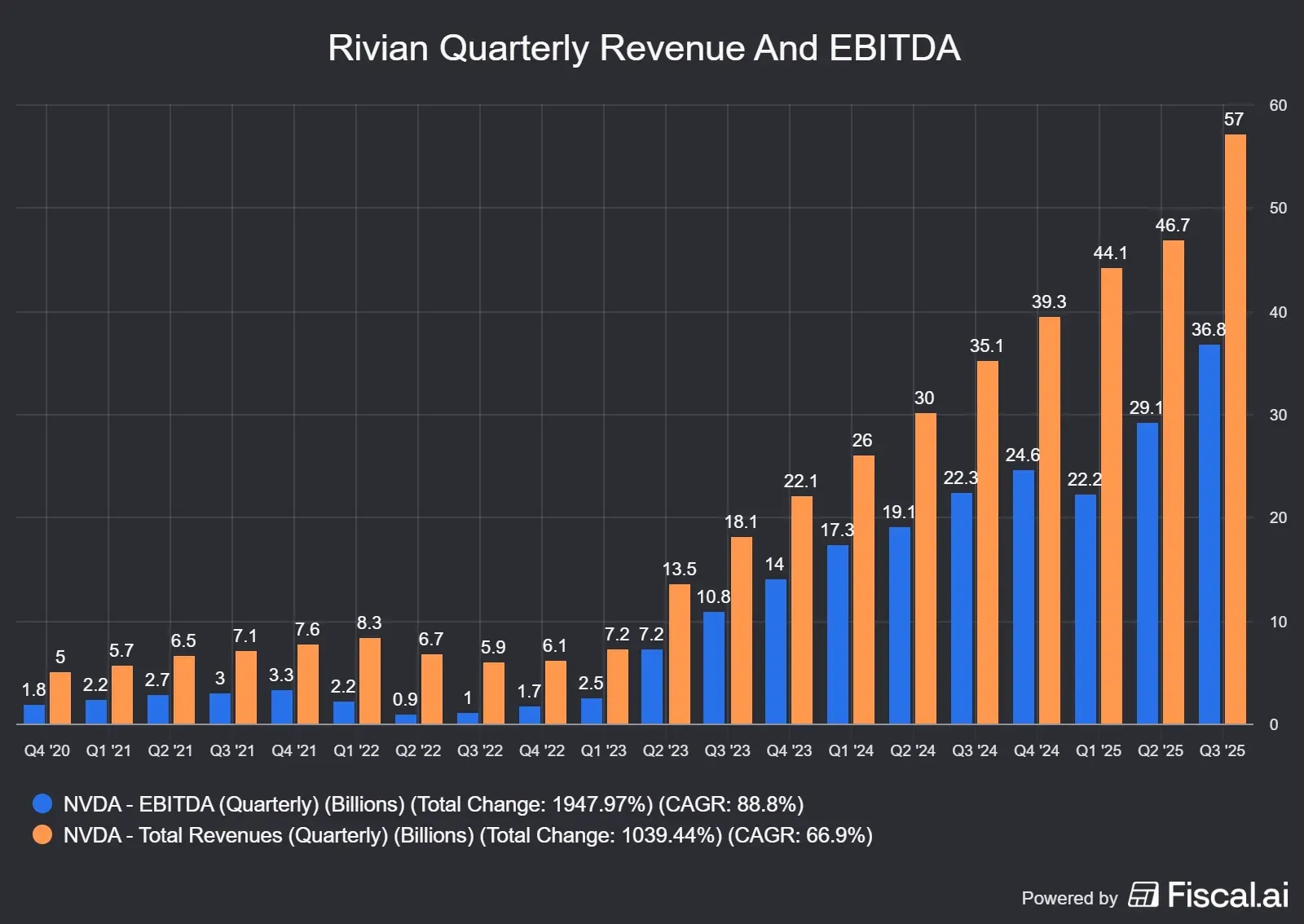

Recent Financial Performance

Rivian reported third-quarter revenue of $1.56 billion, beating Wall Street estimates by 4.9%, and posted a loss of $0.65 per share. Losses exceeded $2.8 billion over the first three quarters of 2025, following a $4.7 billion net loss in 2024.

The company received a $1 billion investment from Volkswagen Group in early 2025 as part of a broader commitment of up to $5.8 billion tied to a software-focused joint venture. Additional tranches are linked to milestone achievements.

Rivian Stock Price Target Outlook

Koyfin data show Rivian’s 12-month average price target at $16.96, implying an upside of about 15% from current levels. The targets range from a low of $10, implying a downside of roughly 32%, to a high of $25, implying an upside of about 69%.

Rivian is covered by 25 analysts, with six rating the stock ‘Buy’, 11 ‘Hold’, four ‘Sell’, and one ‘Strong Sell’.

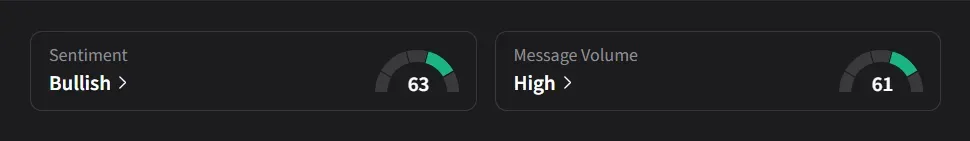

How Did Stocktwits Users React?

On Stocktwits, retail sentiment for RIVN was ‘bullish’ amid ‘high’ message volume.

One bullish user expressed optimism around the R2 event, saying, “The wait is almost over!”

Another user said they “sold some puts to hopefully get a starter position assigned.”

RIVN stock has risen 19% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<