R2 is expected to become the majority of the company’s vehicle volume by the end of 2027.

- Rivian said the launch of its $45,000 R2 SUV will pressure margins in Q2-Q3 of 2026 due to launch complexity.

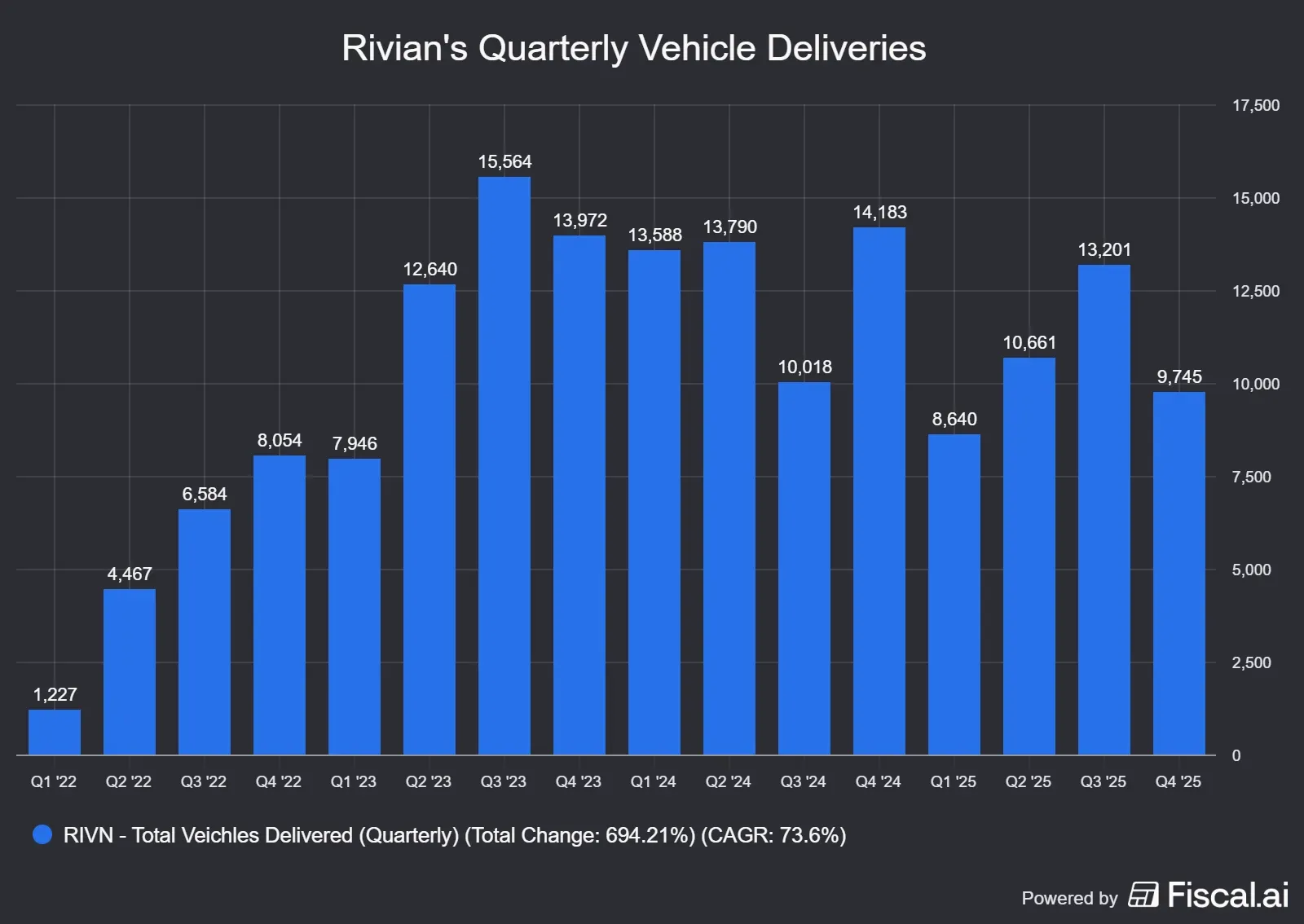

- The company expects to deliver 62,000-67,000 vehicles in 2026, up from 42,247 in 2025.

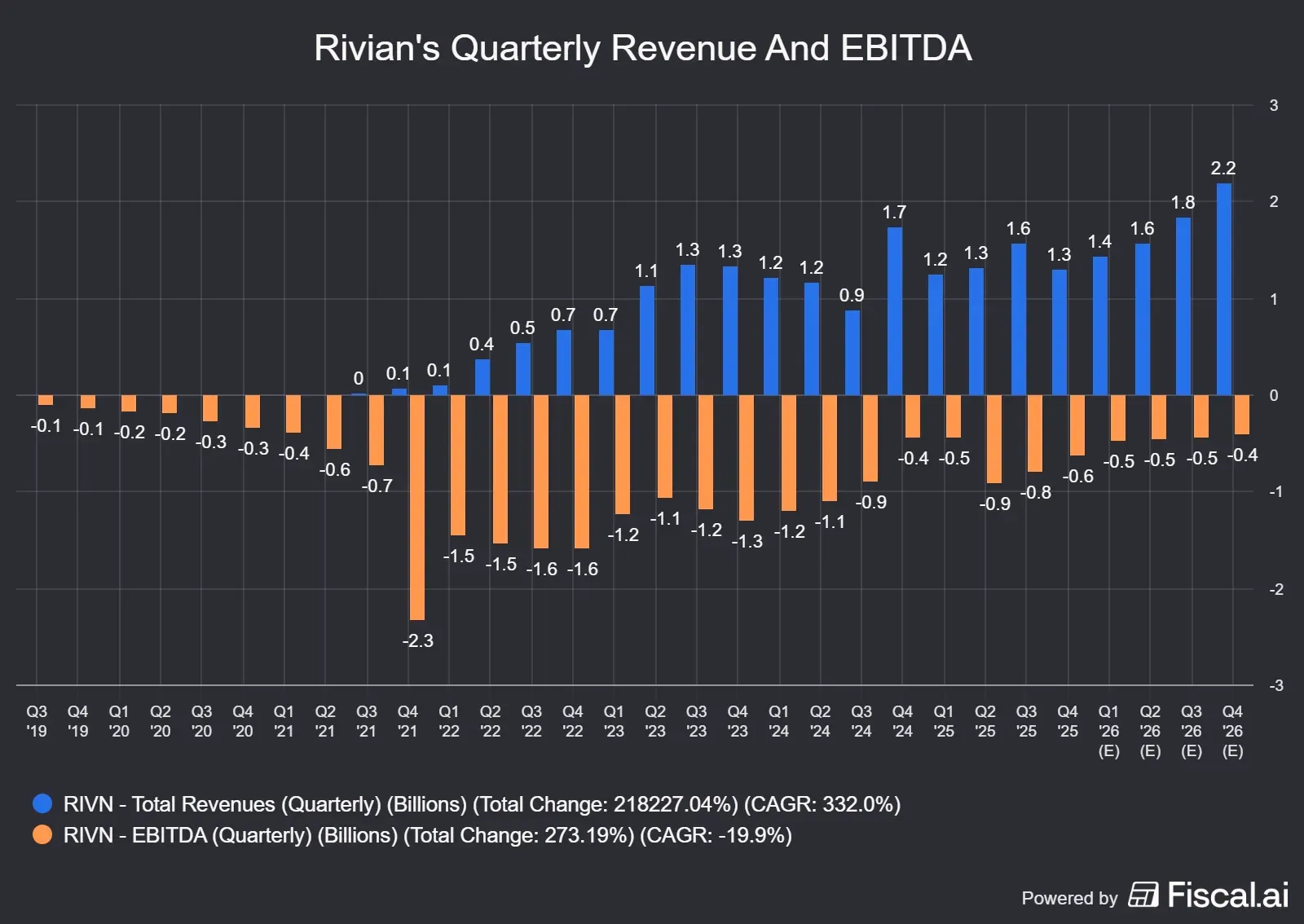

- Rivian reported a narrower Q4 loss and its first positive cash gross margin, generating about $2,000 per vehicle.

Rivian Automotive, Inc. (RIVN) said Thursday that the rollout of its lower-priced R2 SUV will weigh on margins in the first half of 2026, before shifting into a tailwind later in the year as production and deliveries gather pace.

R2 Launch To Pressure Margins In Early 2026

Speaking on the company’s fourth-quarter (Q4) earnings call, CFO Claire McDonough said the “complexity” of launching R2 is expected to pressure automotive gross profit in the second and third quarters of 2026, even as overall gross profit improves from a year earlier.

McDonough expects the R2 launch to turn into a benefit for the company by Q4 of 2026 as production and deliveries scale. CEO RJ Scaringe said on the call that R2 production will start on a single shift at Rivian’s Normal, Illinois plant. A second shift is planned for late 2026, with a third shift slated for 2027. He cautioned that the speed of that ramp-up will depend on supplier readiness and said it can only move as fast as the slowest part of the supply chain.

Rivian has already rolled its first R2 manufacturing validation build off the line. Initial customer deliveries are expected to begin in the second quarter of 2026, with volumes remaining modest early on before building in the second half.

Rivian expects to deliver between 62,000 and 67,000 vehicles in 2026, up from 42,247 vehicles in 2025, with R2 accounting for most of that increase. Deliveries in the first half of the year are expected to run between 9,000 and 11,000 vehicles per quarter, before accelerating later in the year as R2 output improves.

The company expects R1 and commercial van volumes to be broadly in line with 2025. R2 is expected to become the majority of the company’s vehicle volume by the end of 2027.

R2 Launch Edition Details

The R2 SUV is expected to be priced around $45,000, well below Rivian’s current R1 lineup, priced near $70,000. The Launch Edition will come with dual motors, all-wheel drive, more than 650 horsepower, and over 300 miles of range. Rivian plans to share full pricing, trims, powertrain, and battery options on March 12, when customers will be able to start configuring vehicles.

R2 will launch with an upgraded Gen 2 autonomy stack, and the company said the absence of next-generation hardware at launch is not expected to be a major issue. Scaringe said major hardware upgrades, including LiDAR, are planned for early 2027, and that hardware retrofits are not planned. Point-to-point driving functionality, he added, will roll out over time as part of Rivian’s broader autonomy roadmap.

Rivian Q4 Review And Outlook

Rivian reported a Q4 loss of $0.66 per share, narrower than the $0.67 loss analysts expected. Revenue rose to $1.29 billion, topping the $1.27 billion consensus, pushed by stronger software and services revenue tied to its joint venture with Volkswagen Group.

Scaring said in an interview with CNBC that Q4 marked the first quarter in which the company achieved positive gross margin on a cash basis, generating about $2,000 of profit per vehicle on a cash basis.

He told CNBC that the difference between cash profitability and GAAP results was driven primarily by depreciation of roughly $11,000 per vehicle. “Depreciation is going to be amortized over a lot more units as we start to ramp R2,” Scaring added.

For 2026, the company guided for an adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) loss of $1.8-$2.1 billion, in line with the $2.06 billion loss recorded in 2025.

Rivian expects capital expenditures of $1.95-$2.05 billion this year, mainly to complete R2 construction and tooling in Normal, begin vertical construction at its Georgia plant, and expand its sales, service, and charging network. The guidance also reflects higher R&D spending tied to autonomy, including plans to deliver LiDAR hardware, the first RAP1 chips, and limited point-to-point functionality by the end of the year.

Rivian expects to receive $2 billion in 2026 from its Volkswagen joint venture, including $1 billion for winter testing and $1 billion in non-recourse debt. The partnership combines Rivian’s software and electrical architecture with Volkswagen’s manufacturing scale to develop software-defined vehicles.

How Did Stocktwits Users React?

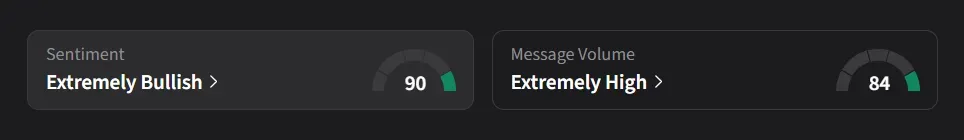

On Stocktwits, retail sentiment was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said, “R2 is a thing of beauty and priced for the middle income. When it rolls out of production line in a few months, i think Rivn stock price will double.”

Another user said, “The return to $30+ is coming by the end of 2026.”

RIVN stock has risen 12% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<