Rio Tinto also announced that it is advancing development at Rhodes Ridge. A pre-feasibility study is expected to be completed this year, and the project is slated to begin production in 2030.

Rio Tinto PLC (RIO) shares fell as much as 2% in morning trade on Wednesday after Japan's Mitsui & Co. (MITSY) signed agreements to acquire a 40% interest in the Rhodes Ridge Joint Venture (RRJV), a major mining project in Australia, from Rio Tinto's existing partners.

The deal, subject to regulatory approvals and other conditions, strengthens Mitsui’s presence in Australian mining and leaves Rio Tinto's 50% stake in the project unchanged.

Mitsui agreed to purchase the entirety of VOC Group’s 25% interest in the venture and separately entered a heads of agreement to acquire an additional 15% from AMB Holdings Pty.

If the second transaction closes, AMB Holdings will retain a 10% stake.

Rio Tinto is advancing development at Rhodes Ridge. A pre-feasibility study, followed by a feasibility study, is expected to be completed this year.

The project is slated to begin production by 2030, leveraging Rio Tinto’s existing rail, port, and power infrastructure.

In a separate development, European industrial and energy company Metlen Energy & Metals (METLEN) announced two long-term strategic agreements with Rio Tinto to improve the supply chain for bauxite and alumina.

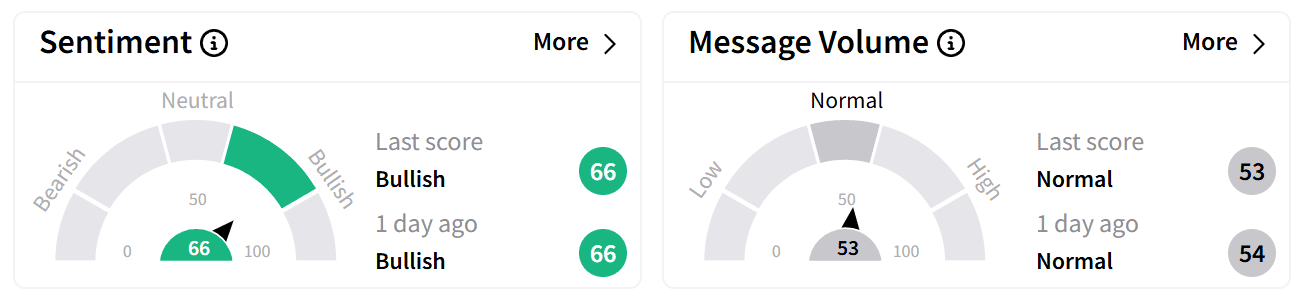

Despite the stock’s dip, retail sentiment on Stocktwits remained ‘bullish,’ with steady chatter.

Rio Tinto’s stock is down 6% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

Read also: Arista Stock Slides Pre-Market Despite Bullish Calls From Wall Street After Q4 Earnings Beat: Retail Sentiment Hits Year-High