Stocktwits data revealed a 42% jump in message volume over the past 24 hours to Thursday, adding to a staggering 9,908% increase in chatter since the start of the week.

Shares of SEALSQ Corp. plunged more than 18% in early Friday trading, a sharp reversal after the stock’s value quadrupled earlier this week.

Although, the stock later staged a partial recovery and was down just 6% by midday.

The selloff followed the company’s announcement on Thursday of a public offering aimed at raising $10 million by issuing 7.69 million ordinary shares at $1.30 each.

Wednesday marked the stock’s best day this year, with prices nearly doubling.

However, concerns over shareholder dilution and the broader implications of the offering seemed to have tempered this momentum.

Retail interest in SEALSQ has surged dramatically amid the volatility.

Data from Stocktwits showed a 42% spike in message activity over the past 24 hours to Thursday, adding to a staggering 9,908% increase in chatter since Monday.

The number of users tracking the stock also climbed by 11% in the last 24 hours, following a 50% increase earlier in the week.

The direct offering has sparked significant debate on the platform over whether existing shareholders’ ownership will be reduced, given that the public offering price was above the market price at the time.

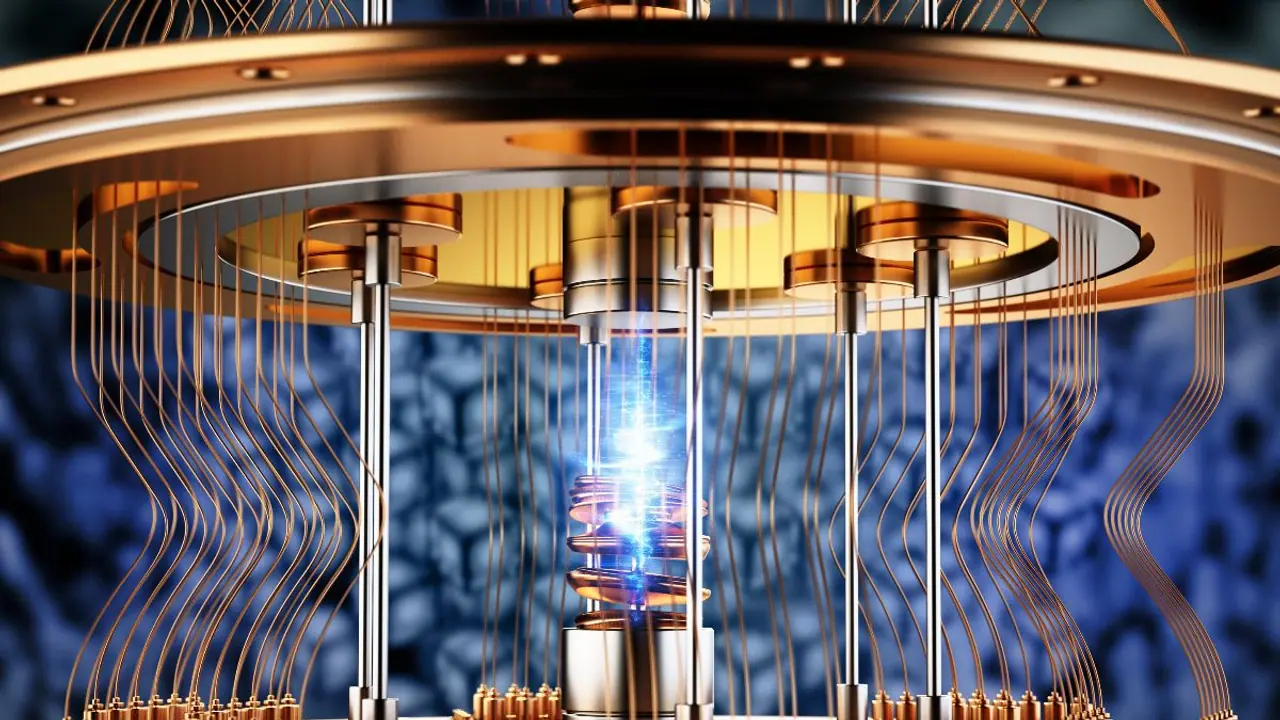

SEALSQ plans to use the funds to accelerate the deployment of its next-generation post-quantum semiconductor technology and ASIC capabilities in the U.S. The offering is expected to be finalized by Monday.

Despite the steep drop, the stock is up nearly 50% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

Read also: Broadcom Joins Trillion-Dollar Club Driving Marvell, Astera, And Other Chip Stocks To Record Highs: Retail Is Doubling Down