According to reports, the Indian conglomerate is expected to report a significant increase in profit, boosted by one-time gains from the Asian Paints stake sale

India’s largest company by revenue, Reliance Industries, is expected to post a significant increase in profit, aided by one-time gains from the Asian Paints stake sale. According to reports, the oil-to-telecoms giant is expected to report a net profit of ₹19,775 crore and revenue from operations of ₹ 241,800 crore.

From a technical perspective, SEBI-registered analyst Rohit Mehta notes strong bullish signals.

On the charts, Reliance is forming a bullish cup pattern with resistance aligning precisely at its previous peak, Mehta said.

A confirmed breakout above ₹1,603 could lead to a new leg of the rally, while the ₹1,250 - ₹1,310 range remains a key demand zone for any potential pullbacks, he added.

A deeper support lies in the ₹977 - ₹1,003 zone.

Reliance Industries’ shares were trading marginally higher at ₹1,479.9 at market open on Friday.

On the financials front, Reliance posted stable growth across the board in the previous quarter. Sales rose 10.51%, operating profit increased 3.10%, and profit before tax grew 4.99%.

However, some structural concerns remain. Its five-year sales CAGR stands at a modest 10.1%, its average ROE is at 8.89%, and dividend payouts have remained conservative at just 9.84% of profits, Mehta noted.

Institutional ownership has seen minor shifts, with foreign institutional investors (FIIs) holding slightly lower at 19.07%, down from 19.16%, while domestic investment (DIIs) increased from 19.02% to 19.36% in the last quarter.

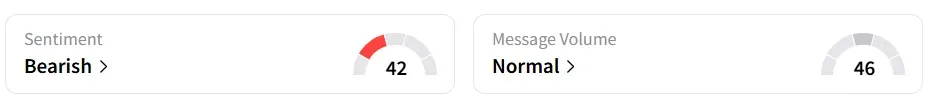

Ahead of the results, retail sentiment was ‘bearish’ on Stocktwits.

Year-to-date, the Indian conglomerate has gained over 20%.

For updates and corrections, email newsroom[at]stocktwits[dot]com<