RBI has relaxed its provisioning norms for project loans, a move that the analysts says will benefit financiers like REC.

In a move set to benefit infrastructure financiers, the Reserve Bank of India (RBI) has released its final guidelines on provisioning for project loans, easing the earlier proposed stringent norms.

SEBI-registered analyst Navodit Tiwari observed that this policy shift is particularly favorable for REC, a key state-run infrastructure finance company, primarily focused on power sector lending.

At the time of writing, REC shares had risen over 3% on Friday.

RBI Eases Infra Loan Norms

Under the earlier draft guidelines, the RBI had proposed a 5% Provisioning Coverage Ratio (PCR) during the construction phase of a project loan, 2.5% during the operational phase, and a reduction to 1% if certain financial milestones were achieved.

The final guidelines have eased these requirements considerably. Now, only a 1% PCR is mandated for general project loans during construction, and 1.25% for under-construction commercial real estate (CRE). In the operational phase, PCR requirements range from 0.4% to 1%, depending on the type of project.

Why Is This Positive For REC?

On the technical charts, Tiwari highlighted that the stock has formed a symmetrical triangle bounded by converging trendlines over the last several weeks.

REC is currently trading near the lower trendline support zone of ₹360–₹380, marked by multiple bounces, which indicates strong demand. However, the stock has been unable to close above ₹420 on a weekly closing basis.

Tiwari recommends entering above ₹420 (provided there is a weekly close), with the first target at ₹470-₹480, followed by a target above ₹550. He advises keeping the stop loss below ₹350 on a weekly closing basis.

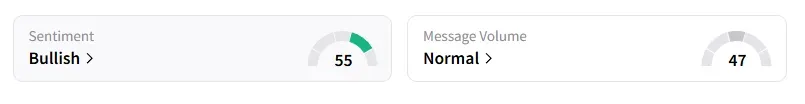

Data on Stocktwits shows retail sentiment is ‘bullish’ on the counter.

REC shares have fallen 21% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<