Petco recently made major changes to its leadership team aimed at operational improvements and helping it return to profitable growth.

Shares of Petco Health and Wellness Co. (WOOF) jumped nearly 10% on Wednesday after-hours trading following the pet retailer’s mixed fourth-quarter results, but retail investors were optimistic about continued share gains.

While Petco’s loss per share came in at $0.05 compared to the consensus estimate of loss per share of $0.01, its Q4 revenue of $1.6 billion was above consensus estimate of $1.56 billion. However, revenue fell by 7.3% due to the loss of an extra week in the 2023 calendar.

Its Q4 net loss narrowed to $13.8 million compared to $22.6 million from the same period last year, and comparable sales increased 0.5% year-over-year.

"Our results in the fourth quarter demonstrate the progress we've made to return Petco to retail operating excellence," said Joel Anderson, Petco's CEO.

"While there is more work ahead, I am confident our new leadership team is well-positioned to build on this early momentum, deliver double-digit adjusted EBITDA improvement in 2025 and set the business up for sustainable profitable growth."

For fiscal 2025, it expects revenue to be down in low single digits year-over-year, and adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) to range between $375 million and $390 million.

Petco recently made major changes to its leadership team aimed at operational improvements and helping it return to profitable growth.

The company said it plans to close 20-30 stores in 2025 as part of this effort.

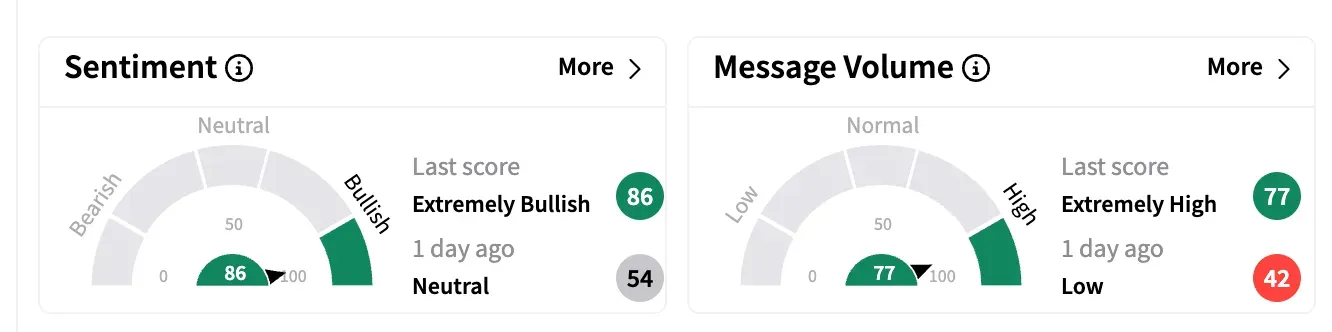

Sentiment on Stocktwits jumped to ‘extremely bullish’ from ‘neutral’ a day ago. Message volume also climbed to ‘extremely high’ from ‘low.’

Despite the mixed earnings, a bullish investor called the results a victory predicting a gradual rise in the share price.

In November, Petco named Joe Venezia its Chief Revenue Officer.

Petco stock is down 36% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<