A breakout above ₹6050–₹6100 could drive the stock toward ₹6300–₹6450, while ₹5700–₹5750 serves as a strong support zone on the downside, according to the analyst.

Persistent Systems’ stock is experiencing a healthy consolidation after recovering sharply from sub-₹4700 levels from mid-April, according to SEBI-registered investment advisor Financial Independence.

Shares of Persistent gained around 12% in the past three months before dropping around 1% over the past week. After the steep rally, it is consolidating in the ₹5900–₹6050 zone.

The stock has maintained a bullish structure, forming a series of higher highs and higher lows, the advisor said.

A decisive breakout above the ₹6050–₹6100 range could trigger the next upward move, with the stock potentially hitting the ₹6300–₹6450 band. On the downside, ₹5700–₹5750 is emerging as a key support zone.

On the technical charts, the Relative Strength Index (RSI) sits at 59.82, suggesting neutral-to-bullish momentum. If supported by strong volumes, the stock may resume its upward trajectory, the advisor noted.

Fundamentally, Persistent Systems is well-positioned to benefit from ongoing global trends such as digital transformation, increased cloud adoption, and the growing use of AI in enterprise operations, they added.

Its earnings visibility and sectoral tailwinds support long-term investment confidence, according to Financial Independence.

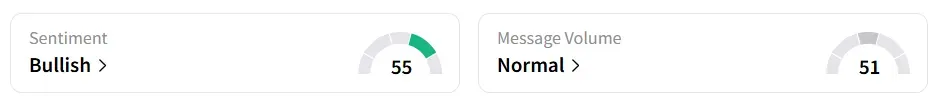

Retail sentiment on Stocktwits turned ‘bullish’ from ‘neutral’ a day ago.

The stock closed 2.3% lower at ₹5,899.50. Year-to-date, the shares have fallen around 9%.

For updates and corrections, email newsroom[at]stocktwits[dot]com<