According to The Fly, the brokerage raised the price target to $26 from $20.

PBF Energy (PBF) stock jumped 10.2% on Tuesday after UBS upgraded the refiner to ‘Buy’ from ‘Neutral’ and boosted its price target.

According to TheFly, the brokerage raised the price target to $26 from $20. The new target price implies an upside of 25% compared to the stock’s last close.

The stock has a consensus price target of $18.15, according to FinChat data.

UBS reportedly cited ‘strong improvement’ in refining fundamentals behind the upgrade.

Analysts at the brokerage noted that surplus heavy barrels drive wider heavy-light spreads, and lower crude prices drive higher demand for refined products.

A Reuters report citing sources said that, according to American Petroleum Institute figures, U.S. crude stocks rose by 4.3 million barrels in the week ended May 9.

Meanwhile, according to Energy Information Administration data, average U.S. gasoline prices are down about 48 cents compared to the year-ago levels ahead of a busy summer driving season.

A 90-day pause on reciprocal tariffs between the U.S. and China has also improved the demand outlook.

PBF reported a first-quarter net loss of $401.8 million, compared to a year-ago profit of $106.6 million earlier this month.

A fire at its Martinez refinery and weak refining margins weighed on its earnings. PBF started limited operations at the refinery in April and expects to bring its full capacity online by the fourth quarter.

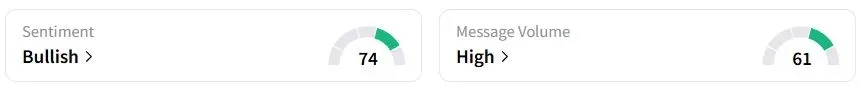

Retail sentiment on Stocktwits was in the ‘bullish’ (74/100) territory, while retail chatter was ‘high.’

One retail trader suggested the stock could see a breakout over $23.02 due to its high short float.

The stock rose further in extended trading to touch $23.25.

PBF stock has fallen 14.6% year to date (YTD)

For updates and corrections, email newsroom[at]stocktwits[dot]com.<