The economist stated that the U.S. raid on Venezuela is not for oil, but rather, for “oil fantasies,” adding that the vast amount of oil reserves that President Trump wants to take from the country do not exist

- Krugman pointed out that the inflation-adjusted price of crude oil had fallen from more than $180 per barrel to nearly $60 per barrel, citing data from the Energy Information Administration.

- Venezuela is currently known to have the largest oil reserves in the world, at nearly 304 billion barrels.

- However, Venezuela’s crude is extremely heavy, resulting in low recovery rates and high production costs, according to Apollo Chief Economist Torsten Slok.

Economist Paul Krugman on Wednesday criticized President Donald Trump’s view that crude oil reserves represent a valuable strategic asset, characterizing the perspective as “decades out of date.”

In his latest post, Krugman noted that oil prices remain low by historical standards. Citing data from the Energy Information Administration, he noted that inflation-adjusted crude oil prices have declined from peaks above $180 per barrel in 2008 to roughly $60 per barrel today.

“Trump’s belief that he has captured a lucrative prize in Venezuela’s oil fields would be an unrealistic fantasy even if he really were in control of a nation that is, in practice, still controlled by the same thugs who controlled it before Maduro was abducted,” Krugman said.

The economist stated that the U.S. raid on Venezuela is not for oil, but rather, for “oil fantasies,” adding that the vast amount of oil reserves that President Trump wants to take from the country do not exist.

The Orinoco Belt Problem

Venezuela is currently known to have the largest oil reserves in the world, at nearly 304 billion barrels. Saudi Arabia comes second, with 267 billion barrels of proven reserves, followed by Iran at 209 billion barrels.

However, Venezuela’s crude is extremely heavy, resulting in low recovery rates and high production costs, according to Apollo Chief Economist Torsten Slok.

“Venezuela’s self-reported crude oil reserves tripled from around 100 billion barrels in the early 2000s to 300 billion barrels in the late 2000s due to the reclassification of Orinoco Belt heavy oil as ‘proved,’” said Slok in a note on Tuesday.

Another problem with extracting crude from Venezuela’s reserves is the country’s aging oil infrastructure. In an interview with NBC News on Tuesday, President Trump said a tremendous amount of money is required for the same, but noted that oil companies will do “very well.”

Trump’s 50 Million Barrels Of Oil Claim

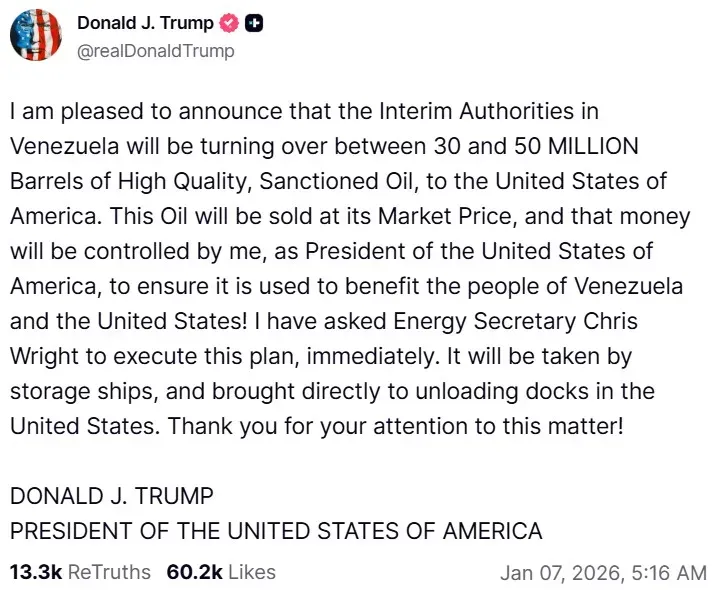

In a post on Truth Social on Tuesday, President Trump stated that the interim authorities in Venezuela will turn over between 30 million and 50 million barrels of “high quality, sanctioned oil” to the U.S.

“This oil will be sold at its market price, and that money will be controlled by me, as President of the United States of America, to ensure it is used to benefit the people of Venezuela and the United States!” he said.

For context, the U.S. produced nearly 14 million barrels of crude oil per day in October 2025, according to data from the U.S. Energy Information Administration. Even at the top end of Trump’s claim of 50 million barrels from Venezuela, it would amount to a little under four days of crude oil production of the United States.

At the current WTI crude oil spot price of $56.33 per barrel, the 50 million barrels from Venezuela would be worth $2.8 billion.

Meanwhile, U.S. equities were mixed in Wednesday’s opening trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, edged up by 0.01%, while the SPDR Dow Jones Industrial Average ETF Trust (DIA) declined 0.33%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘bullish’ territory.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<