“The Big Short” investor first disclosed a short position on PLTR in November.

- Burry said he is working on an analysis of Palantir.

- Despite a boost from blowout Q4 earnings last week, Palantir shares are down about 25% from their peak last November.

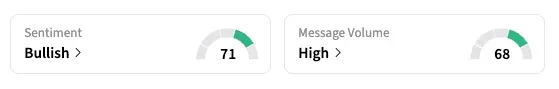

- Stocktwits sentiment dips to ‘bullish’ from ‘extremely bullish.’

Michael Burry’s bearish bet on Palantir Technologies took a small hit after the company delivered exceptionally strong quarterly results last week, but “The Big Short” investor is sticking with the position.

Burry is working on his next analysis on the storied AI software company, he said on X on Monday, with a marked stock chart.

The chart appears to have formed a head-and-shoulders top, according to Burry, and marks a pattern traders often read as a sign that an uptrend may be ending.

The head marks PLTR’s highest point, the record high of $207.52 that was hit in November 2025 following its entry into the Nasdaq 100 index and a series of upbeat earnings reports. The horizontal line around the mid-$140s appears to be a neckline, and a decisive break below this level would be interpreted as confirmation of the bearish pattern.

Burry outlined two support levels: the first around $83, which represents a nearly 42% drop from the last close and a nearly 60% decline from all-time highs. He also marked a “landing area” around $54, which would imply an over 60% slide from the last close and a 74% nosedive from the record peak.

Over the past years, Palantir has consistently delivered strong financial numbers and exceptional stock upside, making it one of the most watched stocks in the market.

In November, Burry disclosed that he had taken short positions in Palantir stock and in AI chip heavyweight Nvidia. At the time, he also made a series of social media posts supporting AI bubble claims and depicting how much of the AI upcycle is driven by partnerships with two companies, Nvidia and OpenAI.

Palantir shares lost steam following Burry’s predictions, dropping about 27% between Nov. 3 and Feb 2, before the company reported blowout fourth-quarter results that showed revenue growing at its fastest pace ever while its orderbook soared by a whopping 143%. Financial forecasts for the first quarter and 2026 also came in much higher than what Wall Street analysts were expecting.

Burry is likely to post a detailed Palantir analysis on his new Substack page, which has drawn increased attention following the investor’s move to deregister his hedge fund, Scion Asset Management, with the SEC late last year.

On Stocktwits, retail sentiment for Palantir was ‘bullish’ as of late Monday, dropping from ‘extremely bullish’ the previous day. PLTR stock jumped 5.2% on Monday, amid a broad market rebound, but is still down nearly 20% in the new year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<