According to a CNBC report, Wells Fargo reaffirmed its ‘overweight’ rating on Oracle, setting a $280 price target that implies a 46% upside from Friday’s close.

- Analyst Michael Turrin noted that investor sentiment around Oracle has turned negative recently.

- He added that some market participants are cautious about Oracle’s exposure to OpenAI.

- Turrin observed that much of the market seems to be pricing in the negative outcomes, while underestimating potential positive developments.

Oracle Corp. (ORCL) has seen its stock drop sharply this year, prompting renewed optimism from Wells Fargo, which believes the decline has created a potential buying opportunity.

The technology giant’s recent struggles have centered on concerns over the artificial intelligence (AI) sector and its high-profile AI partnerships.

Wells Fargo Outlook

According to a CNBC report, Wells Fargo reaffirmed its ‘overweight’ rating on Oracle, setting a $280 price target that implies a 46% upside from Friday’s close.

Analyst Michael Turrin noted that investor sentiment has turned negative recently, largely due to uncertainty surrounding the “AI trade” narrative and competition among AI bellwethers, the report stated.

He added that some market participants are cautious about Oracle’s exposure to OpenAI and the potential execution and financing risks over the next few years.

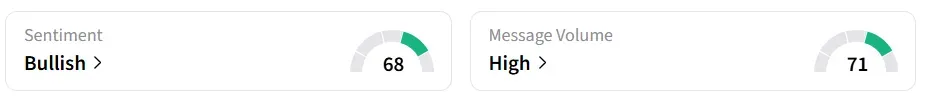

Oracle stock traded over 2% higher in Monday’s premarket. On Stocktwits, retail sentiment around the stock remained ‘bullish’ amid ‘high’ message volume levels.

How Has Oracle Fared This Year?

Shares of Oracle have fallen about 42% from their peak in September. However, Turrin observed that much of the market seems to be pricing in the negative outcomes, while underestimating potential positive developments.

Despite the pullback, there are encouraging signs for Oracle. The company’s latest agreement to manage TikTok’s U.S. business is perceived as a catalyst.

Oracle is part of a group of buyers that will collectively own 45% of TikTok’s U.S. operations. RBC Capital said on Friday that the deal could increase revenue for Oracle Cloud Infrastructure and provide strategic advantages through access to TikTok’s data systems.

According to a CNBC report, OpenAI alone is projected to contribute 25% to 30% of Oracle’s earnings for fiscal 2028 to 2030.

ORCL stock has gained over 15% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<